primeimages/iStock via Getty Images

Because of the recent plunge in the group, the average software stock in the Russell 1,000 needs to gain more than 50% to get back to its consensus analyst price target! The rapidity of the decline hasn't given analysts who cover the group time to catch up to the downside. With share prices now dramatically lower than price targets, analysts have to decide whether to hold firm or start cutting estimates.

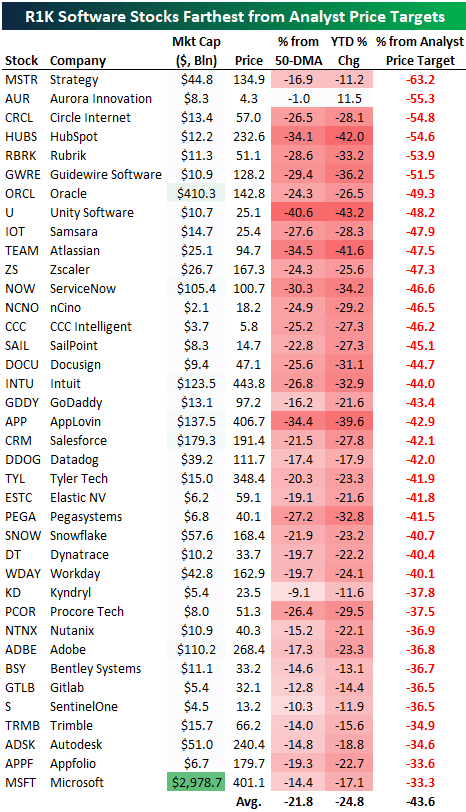

Below is a list of the Russell 1,000 software stocks that are now the farthest below their average analyst price targets. Strategy (MSTR) is the farthest below its average price target at 63%, followed by another five stocks that are more than 50% below: Aurora (AUR), Circle (CRCL), HubSpot (HUBS), Rubrik (RBRK), and Guidewire (GWRE).

Oracle (ORCL) came into the week trading at $142.80, but analysts covering the stock still have an average price target of $282, or nearly double that level. Other large software stocks with $100+ billion market caps that are at least 33% below their price targets include ServiceNow (NOW), Intuit (INTU), AppLovin (APP), Salesforce (CRM), Adobe (ADBE), and Microsoft (MSFT).

As shown below, the software stocks listed came into the week down an average of 24.8% year-to-date and 21.8% below their 50-day moving averages.

Unless share prices have a quick V-shaped recovery, analysts will likely be forced to start lowering price targets, which would potentially act as a further headwind.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.