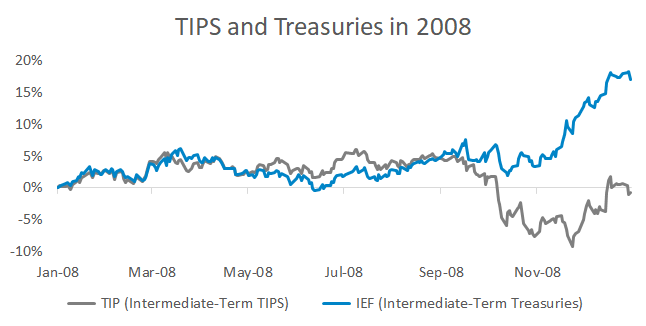

One issue with TIPS is their performance in 2008:

Some investors say "TIPS didn't protect you then, so I'm not using TIPS because that's when bonds should work."

Some investors say "TIPS didn't protect you then, so I'm not using TIPS because that's when bonds should work."The Lehman Brothers bankruptcy is at the heart of why the TIPS market acted so strangely. In 2009, the United States Government Accountability Office wrote:

"Lehman Brothers owned TIPS as part of repo trades or posted TIPS as counterparty collateral. Because of Lehman's bankruptcy, the court and its counterparty needed to sell these TIPS, which created a flood of TIPS on the market."

Lehman's counterparties and the bankruptcy court were forced sellers. A relative value fixed-income fund named the Barnegat Fund was on the other side of the trade.

Barnegat noted the triple whammy facing TIPS in 2008:

- Forced unwind of Lehman collateral

- Real return funds took a bath on commodities and were also forced to sell TIPS

- Nobody was interested in allocating to relative value funds like Barnegat - letting the arbitrage persist for longer

Source: The Barnegat Fund

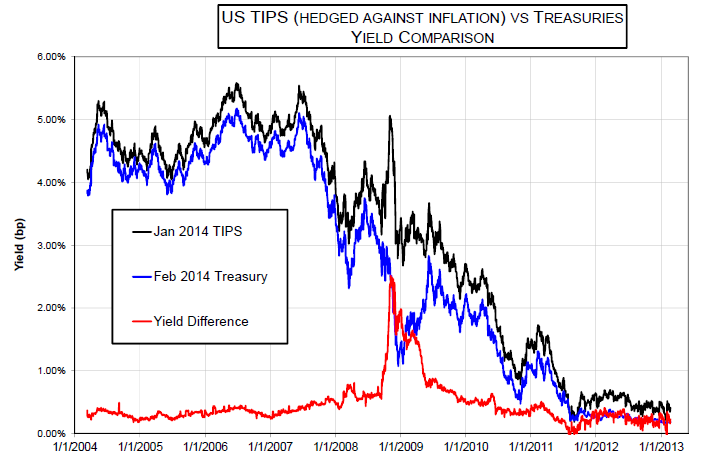

Source: The Barnegat FundBarnegat bought TIPS, shorted Treasuries, and hedged out the inflation risk with inflation swaps. If TIPS were reflecting actual inflation expectations, this trade wouldn't be an arbitrage - it would be a directional inflation bet. But the inflation swaps market wasn't affected by the forced TIPS selling and priced in a less deflationary future than TIPS.

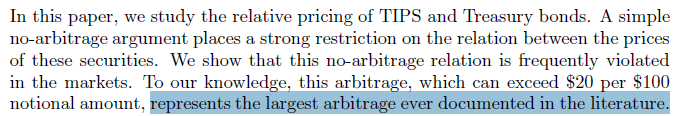

At its peak, the trade netted 2.5% on unleveraged capital with zero credit risk, zero rate risk, and zero inflation risk. Barnegat returned +132% in 2009 and researchers nicknamed the trade "the largest arbitrage ever documented in the literature."

Source: National Bureau of Economic Research

Source: National Bureau of Economic ResearchHere's a video of Barnegat's founder talking about the trade:

While TIPS have been more positively correlated to stocks than regular Treasuries, their performance in 2008 was more of a one-off event than a blueprint for how they'll perform in the next downturn.

For example, TIPS and Treasuries closely tracked each other during the early 2000s recession:

- The Origin of TIPS, How They Work, And the All-Weather Mistake

- Solving the Biggest Bond Risk And Comparing Inflation Hedges

On Monday, I'll explain why TIPS are not the tax nightmare they're made out to be and show an attractive TIPS alternative that's available until October 31.