Jian Fan/iStock via Getty Images

Investment Thesis

With the recent LA wildfires that occurred in January of 2025, property & casualty insurers have been on a roll over the last couple of weeks. One of the companies that was hit heavily was Mercury General Corporation (MCY), which I covered in my recent article. I also covered Skywest Specialty Insurance Group (SKWD), though the company was not much affected by the catastrophic losses of the wildfires. You can refer to the article here. While the insurance industry is a sensitive one, I would say there are lots of opportunities with specialty insurers that cover specific risks. Fidelis Insurance Group (FIHL) is one of these specialty insurance companies that I believe share the same similarities with Mercury and Skywest. Fidelis is trading at a forward P/E of 6.66x, which is a 31.14% discount to its sector median. Fidelis has solid growth prospects, with its forward diluted EPS expected to grow at 2.68% and revenue at 23.65%, a discount of 297.45% against its sector median. In my opinion, the company's 2025 prospects look promising, as noted by the CEO:

As we enter 2025, we are well-capitalized and positioned to drive profitable growth. Our underwriting talent, market access, financial strength and disciplined approach to capital management will continue to differentiate our business and enable us to deliver sustainable value for all our stakeholders

What I find impressive is that this company is executing a disciplined, diversified, and capital-efficient strategy. It has a strong capital base, a high CAGR rate of 36.1% of its GWP, and is rapidly expanding into new markets. As we had seen with Mercury, one of the major advantages of Fidelis is its strong diversification of insurance products, which eventually reduces risk in cases of catastrophic losses. I would also like to note that FIHL has a forward P/B of 0.61x against a sector median of 0.99x, a 38.22% discount. In my opinion, if the company can sustainably grow and maintain its book at 5-10% over the next couple of years, then this could turn out to be a great stock.

Business Overview

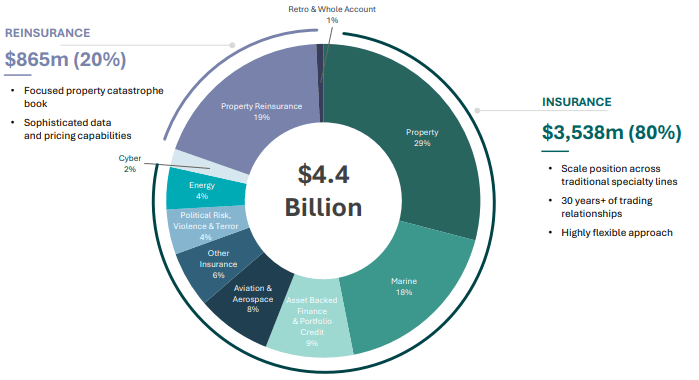

Fidelis has had a well-diversified business since 2015 when it was founded. It operates as a specialty insurance company with offices in London and Dublin. It offers a variety of over 100 insurance products across 10 business lines. As of December 2024, the company's Gross Written Premiums [GWP] stood at $4.4Bn, which is a 22% increase compared to 2023.

Fidelis Insurance Group 4Q2024 Earnings Report

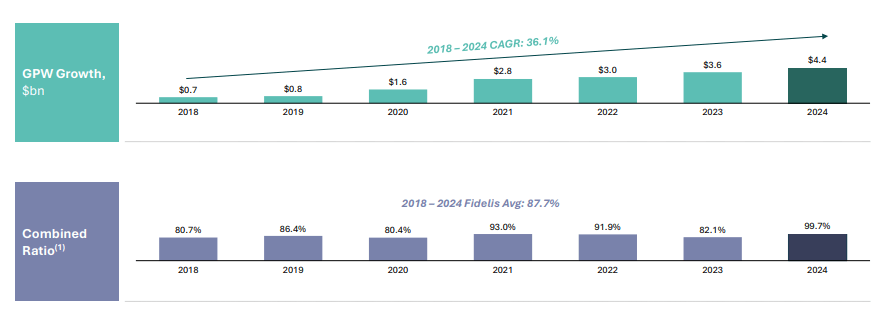

If you look at their GWP since 2018, FIHL has been growing its GWP by a CAGR of 36.1%, which I must say is quite attractive. Additionally, their combined ratio has been increasing over the years, while averaging 87.7%. While its combined ratio has been increasing, it is prudent to mention that Fidelis has had some adverse events in the aviation and aerospace segments, together with the impact of Russia-Ukraine aviation litigation, as noted by the CEO:

These results are inclusive of net adverse prior year period development in our Aviation and Aerospace line of business during the fourth quarter related to business underwritten in 2021 and 2022 (pre-bifurcation) and impacted by the ongoing Russia-Ukraine aviation litigation.

GWP and Combined Ratio (Fidelis Insurance Group 4Q24 earnings report)

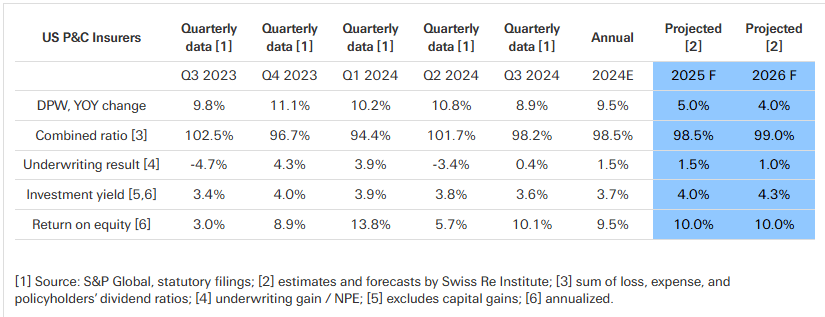

According to Swiss Re, the property & casualty market in the US is expected to experience a stable ROE of 10% in 2025. There is also an anticipated growth in premiums at 5%, as shown below. This coincides with what Fidelis management has guided on their 2025 performance.

US P&C insurance sector Outlook (Swiss Re)

The Structural Bifurcation Effect

In January 2023, Fidelis completed a structural bifurcation. What this meant was that Fidelis would split its operations into two entities with separate functions: Fidelis Insurance Group and The Fidelis Partnership (MGU). In my opinion, this split has had many advantages to date, including a clear separation of risk and capital.

While Fidelis Insurance Group was primarily tasked with managing risk, capital, and returns, MGU would source underwriting business. While working with other institutions such as Blackstone (BX) and Travelers (TRV), MGU's role was to provide access to top-tier underwriting business with zero to minimal costs. As far as I am concerned, this enabled capital growth. As of today, the partnership has expanded to other global players such as Lloyds (LYG) of London. Other companies that have used this model are Arch Capital (ACGL) and RenaissanceRe (RNR) which have seen strong investor support.

Valuation

In terms of historical P/B, Fidelis has been growing its book value

per share at an average of 37% y/y. What I find impressive is that Fidelis is already trading at a 44.6% discount from its book value per share. In my opinion, there is a definite, hidden value in the stock that the market has not factored in yet.

Fidelis Insurance Group 4Q24 Earnings

As mentioned earlier, FIHL trades at a discount against its sector median from a forward P/E and P/B perspective, which reinforces my thesis that the stock could be deeply undervalued, as shown below.

Valuation Factor grade (Seeking Alpha Premium)

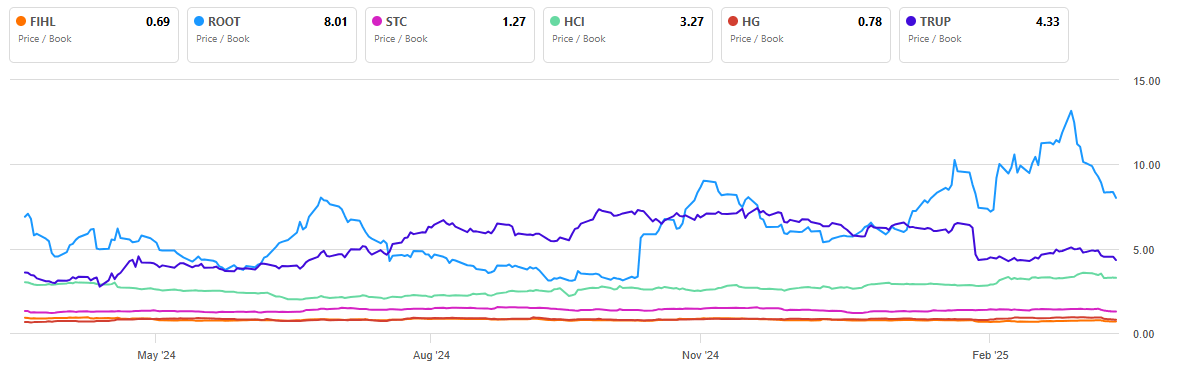

In regard to its peers, it is evident that Fidelis is trading at a lower P/B multiple compared to its peers. While Fidelis trades at 0.69x, Roots (ROOT) trades at 8.01x, Steward Information (STC) trades at 1.27x, HCI Group (HCI) trades at 3.27x, while Hamilton Insurance (HG) and Trupanion (TRUP) trade at 0.78x and 4.33x, respectively.

1 Year P/B Peer Comparison (Seeking Alpha)

Fidelity Key Risks

The biggest risk I see for Fidelis is exposure to catastrophic losses. Fidelis is heavily exposed to reinsurance property catastrophic rates. As we saw with Mercury and Skywest, catastrophic events could be a huge nuisance to a company's long-term growth and profitability. With the huge competition and surge of P&C insurers venturing into this market, catastrophic rates have been declining over the years. However, with the recent catastrophic wildfires, tariffs, rising costs, climate change, and recent hurricanes, there are chances that catastrophic rates will go up. The California Department of Insurance (DOI) is already looking into rate modification, and so will other states and countries.

Final Thoughts

The structural bifurcation has definitely had a positive effect on the overall performance of Fidelis Insurance Group so far. Fidelis exhibits a lot of the characteristics I saw with Skyward Specialty Insurance. A relatively small insurance company. Efficient management. A niche target market and a diversified pool of products. What's interesting with Fidelis is that after the bifurcation, the company has been able to attract more top-tier partners, and this could put FIHL in the big leagues. It may definitely take a while for the company to realize its true value, especially given the fact that the company is still paying claims from old policies and the Russia-Ukraine aviation litigation. However, I still believe that with its consistent growth prospects in GWP, the true value of Fidelis Insurance Group is yet to come.