By Peter Catterall

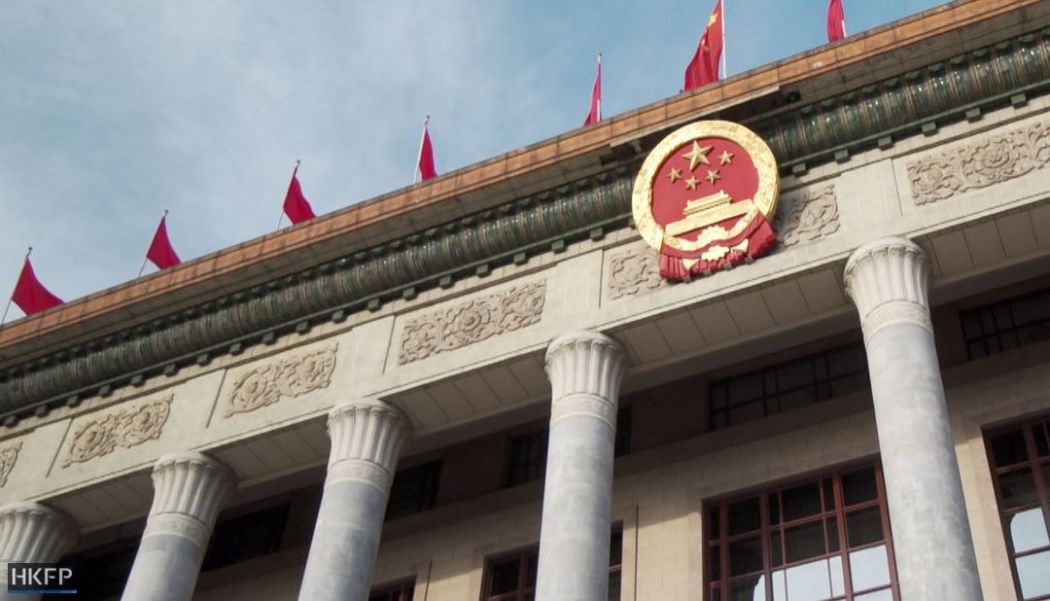

The top brass of China’s ruling Communist Party is gathering in Beijing this week to devise a strategy that will steer the country through 2030 and shape its trade relationships.

Having risen from isolation and poverty just decades ago to become a technological and manufacturing superpower, China is now the world’s second-largest economy, its exports filling global shipping lanes.

However, the challenges confronting leaders are considerable, with a rapidly ageing population, sluggish household spending and heightened trade frictions with the United States and its allies weighing down growth.

This week’s “fourth plenum” of the Central Committee — focused on formulating the party’s next five-year plan and scheduled to conclude Thursday — is being closely watched for signs on how leaders intend to tackle those thorny issues.

Here are the key facets of the economic situation Beijing is staring down:

Consumer slump

Decades of explosive growth in China following sweeping market reforms in the late 1970s and 1980s were largely driven by export-oriented industrialisation and infrastructure investment.

Now, as demographics shift and urbanisation slows, economists argue the country must move towards a model centred on domestic consumption to sustain long-term growth.

But consumer sentiment in China — pummelled by the Covid-19 pandemic — remains cautious.

“Both cyclical and structural factors are behind the weak private consumption,” analysts from ANZ Research wrote this week.

Persistent woes in the real estate sector, a relatively limited social safety net and a highly competitive job market are among factors dissuading consumers.

Policy efforts that emerge from this week’s meeting “are expected to address income inequality and limited social welfare coverage”, the ANZ Research note added.

Adding to the complexity, China’s population has started to decline in recent years, despite Beijing ending its decades-long one-child policy in 2016.

Experts say this trend will result in a smaller workforce and changing consumption patterns over time.

Trade friction

The return of US President Donald Trump to the White House this year, and his unpredictable tariff policies, have presented renewed challenges for China’s export sector — a vital buoy for the economy.

So far, overseas shipments have withstood the pressure, in large part by diverting goods from the United States to alternative markets, especially in Southeast Asia.

However, trade tensions between the world’s top two economies remain unresolved, with Washington working to rally its allies against Beijing’s new curbs in the strategic rare earths industry.

Observers are awaiting a potential in-person meeting this month between Trump and China’s President Xi Jinping — a potential off-ramp to step back from a damaging trade war.

Maintaining rare earth ‘dominance’

China’s edge in the mining and processing of critical rare earths gives it significant leverage in trade disputes, and experts say its supremacy in the vital sector is secure — at least for now.

“While efforts to break China’s dominance will intensify further, Beijing’s grip is unlikely to be loosened in the short to medium term,” said a report Tuesday by BMI, a unit of Fitch Solutions.

Overcapacity

Another closely watched issue is China’s industrial overcapacity.

“Since its property bubble burst around 2021, China has been focused on shifting its economic model toward manufacturing and investment to compensate for weak domestic consumption,” Nomura analysts said in a recent report.

“This has created overproduction in key industrial sectors, compelling China to increase exports to overseas markets.”

That has exacerbated trade tensions, with Beijing accused of flooding global markets in sectors like electric vehicles and solar panels.

Property market crisis

As well as spooking potential homeowners, the collapse of the real estate sector has dampened domestic demand for materials including steel, concrete and glass.

As party officials discuss economic challenges this week, the Nomura analysts wrote, “the primary domestic challenge” during the next five-year period is “cleaning up the property market mess”.