Businessweek | Personal FinanceThe World Feels Weird Now. Here’s How to Invest

Political upheaval, the shock of tariffs, an AI bubble? Financial experts on navigating turbulent times.

The financial news isn’t just the financial news. For many of us, it’s a daily snapshot of how weird the world feels right now. The headlines describe chaos: President Donald Trump’s upending of domestic and global politics, the shock of tariffs, the rise of artificial intelligence tools that could replace our jobs. But the numbers scream optimism: The US stock market is reaching all-time highs, and a basic S&P 500 index fund is worth 90% more than three years ago. We’re anxious even as the markets are making us richer.

Decades ago, Yale University economist Robert Shiller popularized a useful measure of how expensive stocks are: the ratio of their prices to average corporate earnings over the past 10 years, a long enough time to smooth out the ups and downs of economic cycles. Right now investors are paying almost 40 times earnings to hold stocks. The last time the market was this high was during the dot-com bubble of 1999. Once again, technology is driving the boom.

Shiller P-E Ratio

A stock bubble? Maybe. But we’re in a feelings bubble for sure. Most of us understand that it’s hard to time the market and that we’re better off pursuing a steady policy of investing for the long term. What’s different now is the sense that, in the world beyond quarterly earnings statements, we’re on the brink of something big. Maybe it’s positive. It could turn out that AI really is a productivity miracle. Then again, what if AI crashes and takes down the economy with it? Could the massive spending on data centers and chips that’s powered growth suddenly turn into a sinkhole of unpaid debt? Or what if AI is so good it takes my job? (OK, Claude: Write something entertaining about Shiller p-e ratios.) What if a Federal Reserve under political pressure can’t rein in inflation? Or tariffs turn out to be the economic drag most economists say they’ll be? It’s easy to imagine history taking a big swerve, and that’s even counting the out-of-nowhere black swan events that can suddenly rattle an exuberant market. Standard advice to stay the course feels inadequate.

This spring, when the S&P 500 was reacting (poorly) to rhetoric about tariffs, these were the questions we started asking ourselves—and we haven’t stopped. We wondered what people who think about the answers for a living would suggest to the average investor. We’ve compiled their wisdom in the articles below.

It’s possible we’ll look back on 2025 as a great year to have sold stocks. But in 2011, I gave myself an expensive lesson about the potential downside of extreme market-timing moves. Then, as now, politics loomed large: The Republican Congress was threatening not to raise the debt ceiling, which could have led to the US defaulting on Treasury payments, setting off a chain reaction of financial panic. I decided to take money out of the stock market and put it into bond funds until the crisis passed. It did. The trouble, I soon found, was how psychologically difficult it was to put the money back. Like most people, I built up my investment portfolio over years of making small contributions. But now I had a nest egg’s worth to invest in stocks all at once. I missed out on a decent stock market while I dallied.

So how does one balance the urge to do something with a realistic humility about one’s skills in market prediction? First, make sure you’re not taking more stock market risk than you can handle. The buy-and-hold mantra of a lot of personal finance advice may suggest stocks reliably come back from a crash if one waits long enough. But that’s a rule of thumb, not a law of physics. A Japanese stock investor in 1989 would’ve waited until last year to see the Nikkei 225 index get back to that level.

Nikkei 225 Stock Average

More important, even if stocks do rebound in a few years, investors close to or in retirement won’t benefit as much if they find themselves having to eat into a diminished stock portfolio. “Over age 50, I’d be serious about looking at my portfolio’s fixed-income and cash exposure,” says Christine Benz, director of personal finance and retirement planning at Morningstar Inc. For many at that age or older, that means having 30% to 40% of assets in these safer categories. You want to be able to fund several years of retirement without touching your stocks.

This is also a good moment to check on one’s savings. The stock gains of the past several years are extremely unusual. You’ve had the market’s wind at your back when it comes to meeting financial goals, so run the numbers to see what would happen if returns were much lower. Vanguard Group Inc.’s latest model of future returns—based on a mix of valuations, profit trends and macroeconomic conditions—suggests US equities may grow at a bracingly slow 3.3% to 5.3% per year over the next decade.

Young and older workers alike should also ensure they have a cash emergency fund in case they lose their job, whether or not it’s to a robot. This is always challenging: It’s easy to come up with more compelling uses for spare money, and it’s hard to keep it in cash when you’ve seen profits pile up in everything from Nvidia Corp. share shares to meme stocks to Fartcoin.

Market Return

Diversification makes more sense than ever, including in international stocks, which, after years of lagging the US market, are relatively cheap. They’ve started to make a comeback this year. One can also hold a broad cross section of stocks in industries besides tech. That’s true even for people bullish on AI’s future. Joe Davis, Vanguard’s global chief economist, argues that if the tech lives up to the hype, it ought to make all kinds of businesses more productive and profitable.

One more thing you can do to feel in control: Be skeptical of new or exotic investment ideas and financial products. Deregulation in Washington could make this a golden age for rip-offs. Beyond fraud, frothy markets such as this one also bring overpriced and overhyped ideas to the surface. Social media is promoting get-rich trading strategies, including crypto stocks and complex options-based exchange-traded funds. Managers of so-called alternative assets such as private equity funds want to tap the retirement market, offering the hope of higher returns and the certainty of higher fees. For most investors, low-cost, diversified index funds are still the building blocks of a good portfolio.

There are a lot of existential questions to ponder. But the two most important things to ask—Have I saved enough? Am I comfortable with the amount of risk I’m taking?—have the benefit of being grounded in reality, and that’s about as much as you can hope for these days. —P.R.

Can Anything Slow Down This Market?

Artificial intelligence, tariffs, battles with the Fed and the loss of immigrant labor could test its resilience.

US stocks have been on an epic roll for about 15 years. There were bumps along the way, but the S&P 500 has largely powered through inflation scares, interest-rate hikes, corrections, mini bear markets, wars, a pandemic, a growing fiscal deficit and presidents with wildly different agendas. This spring, concerns about fallout from tariffs set off an almost 19% drop in the index, but by early October it was up about 35% from its April 8 low. Outside of a market-crushing episode no one can predict, what would it take to derail this market? Bloomberg Businessweek asked veteran market watchers to map the fault lines.

Nothing Stops the S&P

Change since Dec. 31, 2009

Nothing Stops the S&P

Change since Dec. 31, 2009

Tariffs, AI and the Fed

The market’s recent resilience can be explained, in part, by the time it takes sweeping changes to show up in the economy, according to Ben Inker, co-head of asset allocation at investment firm GMO LLC. Inker says the stock market tends to overreact initially to new and potentially scary events, then sees they’re not the end of the world. “We go from people freaking out to people shrugging and saying this isn’t a big deal,” he says. “It very well might be a big deal. It’s just going to take a while to really see all the consequences.”

This could be the case with tariffs, Inker says. Other shocks that will take time to filter through the economy, he adds, are the loss of immigrant labor and the way uncertainty—about tariffs, labor and other issues—slows businesses’ process of making strategic decisions.

In the meantime, the massive scale of build-outs for artificial intelligence data centers has become material to the economy, Inker says. “If that AI spending were to stop growing, that’s a scary thing, because so much of the market depends on the ‘hyperscalers,’ ” he says, referring to major beneficiaries of the AI boom such as Alphabet, Amazon.com and Microsoft.

What would “really freak the market out,” Inker says, is the potential damage caused by the showdown between President Donald Trump and Federal Reserve Governor Lisa Cook. Trump wants to remove Cook based on allegations of mortgage fraud; Cook disputes the charges and has sued to stay on the job. (On Oct. 1, the US Supreme Court said Cook couldn’t be immediately ousted.) “Fed credibility matters, and I don’t understand how their credibility could survive a situation where it is clearly not independent,” Inker says.

Less exceptionalism

America’s markets can’t continue to outpace global ones to the massive degree they have since 2009, says Lisa Shalett, chief investment officer at Morgan Stanley Wealth Management. In a recent paper, “American Exceptionalism: Navigating the Great Rebalancing,” Shalett laid out ways the US is becoming less “special.”

“We are entering a far more challenging period,” she says. Rather than seeing US stocks compound at 15% a year, she expects future returns to be closer to 5% to 6%. Those lower returns mean many other asset classes around the world become more competitive to investors, she says.

Cracks are already emerging in the US exceptionalism story, Shalett says, with the gap between American and foreign long-term interest rates narrowing, leading to a depreciation of the dollar. Slower-moving hits to the country’s economic edge include the loss of immigrant labor. Aging populations have weighed on economic growth in Europe, Japan and China, but in the US, immigrants have kept the working-age population younger. “Immigrants enter the workforce at a much higher rate because they tend to be young, and they tend to grow our population at a higher rate than native-born Americans,” Shalett says.

She stresses that she’s not saying the US is in a bubble. She also says the promise of AI could be enormous. But “the US is trying to do a lot of things right now, and the market is so richly priced,” Shalett says. “From here, let’s have more modest expectations.”

The wealth effect

The stock market’s long rise is masking underlying economic weakness and pushing off a recession, says Doug Ramsey, chief investment officer at Leuthold Group. He’s noticed warning signs in labor market data, pointing to nonfarm payroll numbers, where job growth has slowed, to 0.9% from 1.3%, from the same period a year ago. It’s rare to see such growth fall below 1% and still have the economy in expansion mode. “As that number drops, the economy’s resilience to any sort of external shock weakens,” Ramsey says.

Ramsey argues that fat balances in investment accounts are fueling strong consumer spending by top earners. Spending by households that make up the top 10% of US earners accounted for almost 50% of all spending in the second quarter, a record stretching back to 1989, according to Moody’s Analytics. A linkage between asset prices and consumer spending, which makes up about two-thirds of US gross domestic product, is known as the “wealth effect.” And if much of consumer spending is tied to higher asset prices, it could leave the economy vulnerable to market drops. “I’d argue that the wealth effect is more important than it’s ever been,” Ramsey says, “simply by virtue of the fact that the stock market is much larger, relative to the economy, than it’s ever been before.” —S.W.

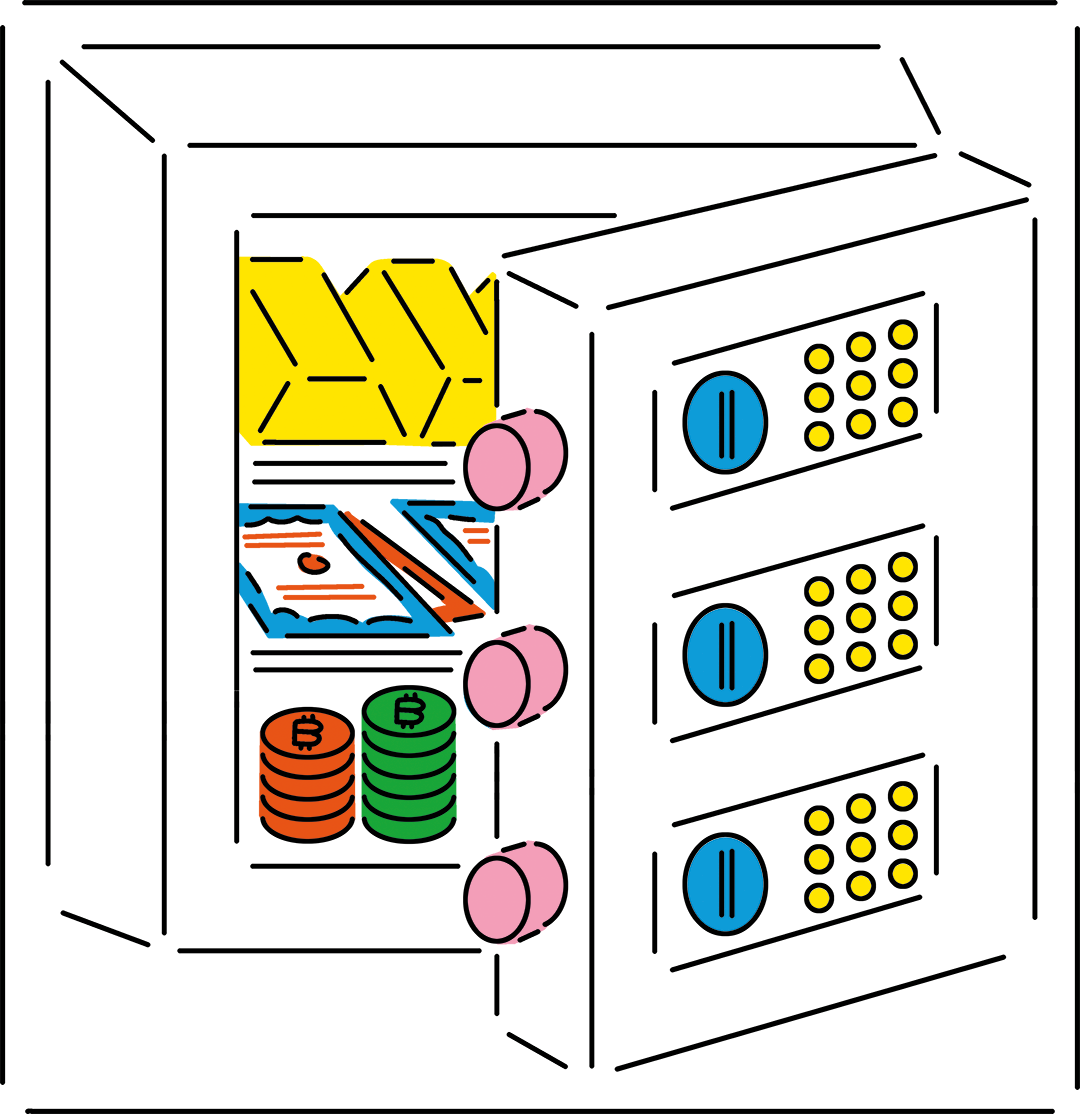

Do I Want Private Market Assets in My 401(k)?

Maybe, but there are potential downsides to consider, including that it’s not clear you’re going to get better returns.

The industry selling “alternative assets” such as private equity, private credit and private real estate wants to get into your retirement plan. Badly.

About $13 trillion is stashed inside defined contribution plans, the most well known being the 401(k). With many large institutions holding about as much as they want in private market assets, the industry needs someplace new to sell into. The reason such assets should be added into 401(k) plans is, arguably, not as clear-cut.

The pitch: Pension plans, institutions and high-net-worth individuals have been able to invest in private market funds for years. So why shouldn’t 401(k) savers—who may also have the long time horizons these products require—have access? Some target-date funds already include private real estate, but access to private equity and private credit is rare.

Proponents say exposure to younger, potentially faster-growing companies could provide a performance edge and improve diversification to portfolios. Advocates also point out that as many companies stay private longer, they make up a growing chunk of the economy.

It sounds logical. But financial planners tend to be skeptical. “For many savers, trade-offs in areas like liquidity, valuations and fees can outweigh the potential benefits,” says planner Nathan Sebesta, founder of Access Wealth Strategies.

Cloudy performance picture

How much of a return edge private market assets will bring is up for debate. A June BlackRock Inc. report estimated that adding slices of them to a defined contribution account as part of a diversified target-date fund could result in 15% more money in an account over 40 years.

Returns, however, vary greatly by manager. And academic research isn’t conclusive on whether private markets outperform public markets on the whole, says Marlena Lee, global head of investment solutions at Dimensional Fund Advisors. “Data on the private side of the markets is less available,” she says, “and what’s there isn’t as high-quality as what’s there for public markets.”

It’s also unclear what more competition in private markets means for returns. “When investments initially offered only to institutional and high-net-worth individuals are offered to Main Street, it usually means the biggest profits have already been made,” says George Gagliardi of Coromandel Wealth Strategies.

Higher fees

Expenses have been on a long decline in 401(k)-type plans, and private market assets are known for high fees. “There are legitimate questions about whether private investments will consistently outperform traditional market investments after accounting for the higher level of fees,” says Jon Henshue, director of alternative strategies at Johnson Financial Group.

There are also concerns about how much access savers will have to money held in private market funds. Historically, funds might lock up assets for 7 to 10 years, though newer funds aimed at retail investors offer much more access.

“I’m open to the idea of private market assets in 401(k)s,” Henshue says, “if it includes strong fiduciary oversight, conservative allocation limits and stringent manager selection.” —S.W.

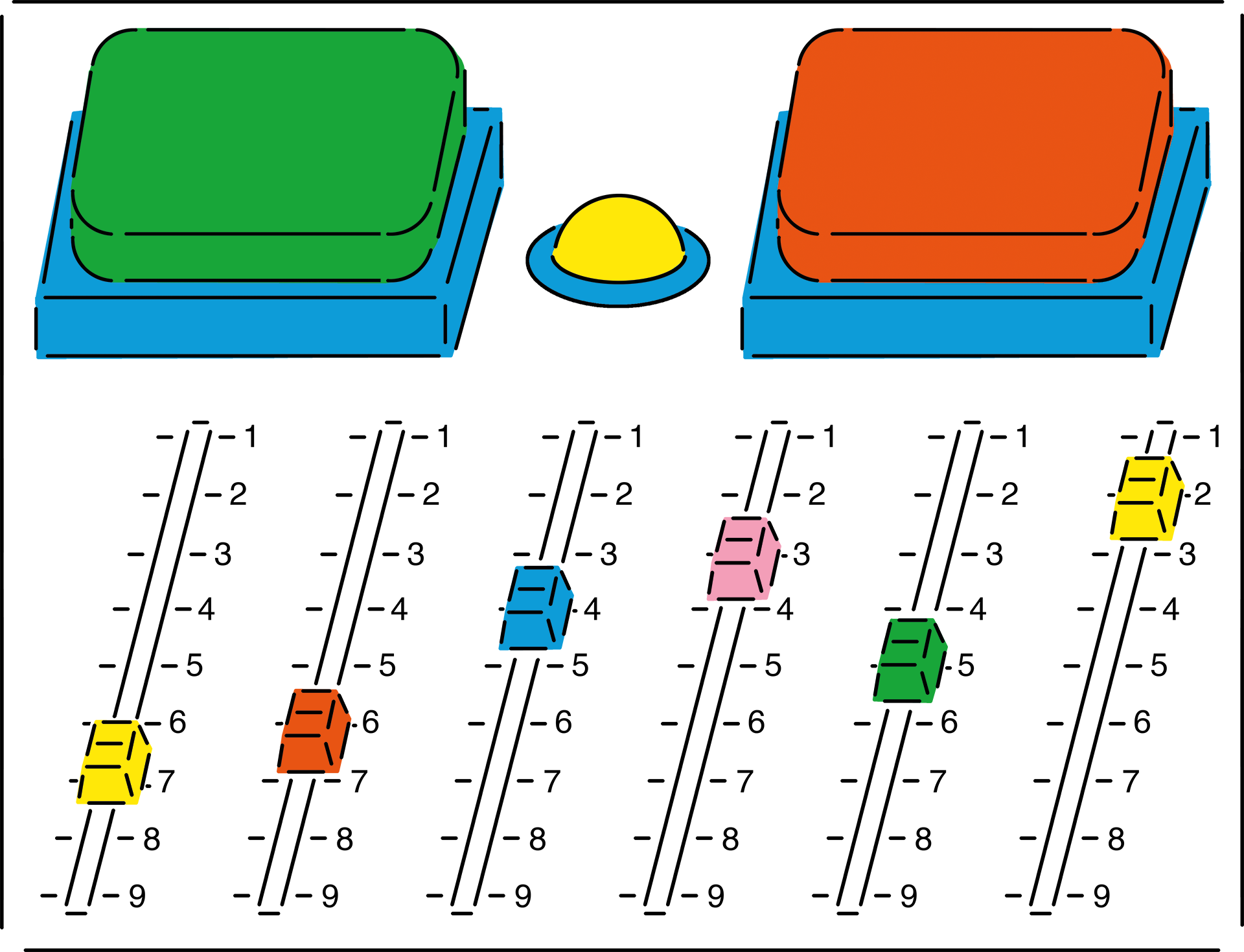

How Can I Get the Right Mix of ETFs in My Portfolio?

Six that cost less than their more popular counterparts.

Companies that sell cars, clothes and cosmetics offer similar items at different price points to meet varying consumer needs. It’s the same for financial products such as exchange-traded funds. Their makers often sell products that allow buyers to invest in the same asset class but with higher or lower fees, depending on demands like liquidity, strategy and size. As a rule, the better known, more specialized or more actively managed an ETF is, the more it will cost.

“ETFs are like snowflakes,” says Bloomberg Intelligence’s senior ETF analyst Eric Balchunas. “Even small differences with holdings, weightings or fees can have big differences in your outcomes.” He suggests shoppers ask three questions: First, what does the ETF hold? Second, how much does it cost? And third, who is the issuer? (More established names are likely to be more dependable, though up-and-comers can still provide value.) Investors are busy, Balchunas says, so the average person should focus mainly on cost. But taking these three factors into account should get you about 90% of the way to the right ETF for you.

Here are six hot sectors, with pricier and cheaper ETF options for each. If you’re asking why the references to liquidity matter—it lets an investor buy and sell faster to profit from changes in price—then that’s probably not relevant to what ETF is right for you. —C.W.

① GOLD

② TREASURIES

③ EMERGING MARKETS

④ DEVELOPED COUNTRIES (NOT INCLUDING US AND CANADA)

⑤ NASDAQ

⑥ S&P 500

How Should I Invest If I’m Bullish About the US?

Many financial advisers still want exposure to Big Tech. But If today’s frothy valuations frighten you, look to the potential AI winners of tomorrow.

The gains in the US stock market have been hard to beat. In 2023 and 2024, investors in the S&P 500 enjoyed total returns of about 25%. So far this year, the index is up about 13%.

The big question is whether the outsize returns can continue. If you’re bullish on America, is it wise to stick with Alphabet, Microsoft and Nvidia? Or is it smarter to look at parts of the market that offer better value and may yet shine?

Many portfolio managers and strategists still want exposure to Big Tech. Some are looking for future AI winners in areas such as health care, whereas others figure the optimism about AI’s promise has peaked and are looking to the industrial sector, which includes aerospace, defense and transportation companies.

Empower Chief Investment Strategist Marta Norton is nervous about tech valuations. But, she says, “the reality is, if I were to go to sleep and wake up in 10 years, I’d still want some exposure to them.” Norton is looking beyond obvious AI plays: “When you look out 10 years and at what AI portends to do, it’s hard not to be bullish broadly and, in particular, in areas where there is no bullishness from AI baked in.” By that, she means a sector such as health care. “There are very clear AI ramifications for research-and-development spending, and streamlining and bringing drugs to market,” she says. “But it’s such a beleaguered sector with concerns around policy and tariffs and the like.” The potential applications of AI make the most sense to Norton in areas with heavy R&D efforts, such as pharma and biotech.

Simeon Hyman, global investment strategist for ProShares, also has concerns about tech valuations. But he’s focused on small-cap stocks; because they often have floating-rate debt, they pay their lenders an interest rate that’s a few percentage points above a short-term benchmark such as the federal funds rate. When the Federal Reserve cuts rates, the interest payments these companies owe drops. “There is a little bit of an extra opportunity,” he says.

Even if AI stocks take a big hit, the economy will hold together, says Michael Grant, co-chief investment officer and head of long-short strategies at Calamos Investments. “We could have 30% to 50% corrections in some of these names without it undermining the fundamental story. The private sector in the US is incredibly robust, and Trump’s pro-growth agenda is very positive for 2026 and beyond.” Grant doesn’t see much opportunity in richly valued tech stocks, but he likes businesses driving automation in domestic manufacturing, as well as electrical; energy; and heating, ventilation and air conditioning companies tied to AI data centers. —S.W.

How Should I Invest If I’m Bearish About the US?

No one suggests cashing out of the US stock market, but it might be time to diversify internationally.

Maybe it’s trade tensions. Maybe it’s sticky inflation. Maybe it’s the current occupant of the White House or even just a sense that what goes up must come down. Whatever the reason, money managers say they’re increasingly fielding queries from clients bearish on the performance of US stocks, the dollar and the broader economy.

To be clear, none of these advisers suggest cashing out of the US stock market. No matter how much the strength of tech stocks masks weaknesses in other sectors, most of them caution that changes investors make to their portfolios should be in moderation. Think hedges, not pivots.

Several say that diversification is likely wise. International investments “could help smooth the ride,” says Neil Krishnaswamy of Krishna Wealth Planning. That’s because, despite the success of the US stock market during the past 15 years, he says, there’s no guarantee it will continue to outperform other markets. Start simple, says Dennis Huergo of Wealth Enhancement. Investors might consider MSCI ACWI, he notes, an equity index capturing a broad swath of large- and mid-cap stocks across developed and emerging markets. It’s weighted about 65% to the US and 35% internationally.

Northern Trust’s Brad Peterson says his company has been advising clients to increase their allocation of European stocks. The continent has relatively high returns at lower price points than similar US equities. Markets have been supported because Europe’s main central bank started cutting interest rates before the Federal Reserve with a goal of stimulating the economy. The region’s largest economy, Germany, is “leading the way,” Peterson says, boosting spending by billions of euros after years of austerity. The Vanguard European ETF (VGK) has been popular with investors this year.

Beyond equities, Peterson also likes global infrastructure investments such as cellphone towers, electric transmission grids, ports, railroads and toll roads. This sector tends to perform well in higher-inflationary environments, the AI boom is increasing demand for it, and many assets are still trading at a discount relative to tech. Investors can look to exchange-traded funds such as the iShares Global Infrastructure ETF (IGF) or the SPDR S&P Global Infrastructure ETF (GII).

Kevin Brady of Wealthspire says bearish investors might consider gold too. Gold has been blowing past records this year, up by more than a third, making it one of the best-performing major commodities. Mounting risks in geopolitics, the US economy and global trade are driving demand for gold, which starts looking like a safer investment given its historic stability and liquidity. But tread carefully: Brady points out that gold also has periods where it underperforms major stock indexes, and diving full-scale into any investment based on how investors think the wind will change is unwise. “It’s all about trying to hedge potential risk down the road,” he says. —C.W.