The past one year has seen the market correct sharply and recover swiftly from April this year. However, the momentum was slowed by penal US tariffs, geopolitical tensions and relatively moderate corporate earnings in recent quarters for many sectors.

While there are concerns on the export front, over the medium term, there are many positive triggers for the market. The new lower income tax rates, reforms in GST, the pay commission for government employees from 2026-2027, interest rate cuts and low inflation are all set to give consumption and domestic growth a fillip.

For retail investors looking to gain from any broader market rallies, and with the ability to withstand a fair degree of volatility, adding a mid-cap fund could be a gainful move over the long term. Though valuations aren’t inexpensive, there are pockets of opportunity.

Invesco India Midcap fund is one of the most consistent and top-quality performer in the category and may suit investors with a reasonably high-risk appetite with a 7-10-year horizon.

As a fund that takes a mix of value/contrarian and growth approaches to stock/sector selection with a strong track record, the scheme can be a good addition for a key portion of an investor’s portfolio.

Given that it is a mid-cap fund and as investment horizon is fairly long, investors can take the SIP route for exposure.

Consistent outperformance

Invesco India Midcap (Religare Midcap earlier) has been around for more than 18 years.

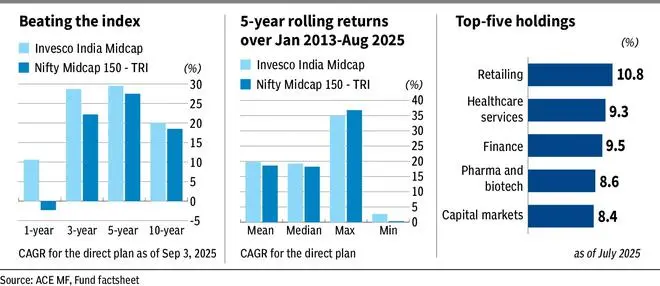

Over the long term, the fund has managed to beat the Nifty Midcap 150 TRI by up to two percentage points – on a point-to-point returns basis – in a category where beating the index is not very common.

When 5-year rolling returns are taken from January 2013 to August 2025, Invesco India Midcap beats the Nifty Midcap 150 TRI for as much as 83 per cent of the time, one of the highest in the category. The mean returns over the aforementioned timeframe and rolling period are a healthy 19.8 per cent, while that of the Nifty Midcap 150 TRI is 18.6 per cent.

Again, when 5-year rolling returns are taken over January 2013 to August 2025, the fund has given more than 15 per cent returns during 73 per cent of the times and over 18 per cent for nearly 57 per cent of the time.

A monthly SIP in the fund for the past 10 years would have delivered 22.8 per cent returns (XIRR), while systematic investments in the Nifty Midcap 150 TRI would have given 20.1 per cent over the same period.

The fund has an upside capture ratio of 130.8, indicating that its NAV rises much more than the benchmark during rallies. It has a downside capture ratio of 89.3, suggesting that the scheme’s NAV falls much less than the benchmark during corrections. A score of 100 indicates that a fund performs in line with its benchmark. This inference is based on data from August 2020-August 2025.

All data points relate to the direct plan of Invesco India Midcap fund.

Deft portfolio moves

The fund largely sticks to its mid-cap mandate. However, the scheme also takes exposure to large and small-cap stocks when necessary, depending on market conditions. For example, the recent July portfolio indicates that 15 per cent of the portfolio is in large-caps, which lends greater stability to the portfolio.

In terms of portfolio moves, the fund invested more in auto components and industrial products in the immediate years post-Covid, as valuations were attractive in these segments. It had also invested in pharma and software firms. All these moves paid off as these segments rallied well.

Exposure was pared in the aforesaid segments as a combination of valuations, business prospects and macroeconomic scenarios turned adverse from early to mid-2024.

Interestingly, the fund upped stakes in realty stocks, a rarity in the mutual funds space as the real estate segment saw solid growth over the past 3-4 years and continues to be resilient. As correction was steep in retailing stocks, the fund increased exposure to retailing, which is now the top sector in Invesco India Midcap fund’s portfolio. Healthcare services have also seen upping of stakes as have capital market stocks. The fund has also increased exposure to finance stocks.

Overall, the fund takes an approach that combines valuations/contrarian takes, momentum and growth approaches, resulting in solid performances over the years.

Exposure to individual stocks is generally restricted to less than 5 per cent and even sector exposures rarely go to double digits barring the top couple of holdings.

Generally, the fund holds a compact portfolio of 45-50 stocks.

The fund generally remains fully invested for most parts and rarely takes cash calls.

Overall, the fund is suited to be in the core part of an investor’s portfolio, though the time horizon needs to be 7-10 years or more.

Published on September 6, 2025

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.