Indian Refiners Halt Russian Oil Purchases To Mull Options

By Editorial Dept - Aug 01, 2025, 10:00 AM CDT

Numbers Report – August 01, 2025

In the latest edition of the Numbers Report, we will take a look at some of the most interesting figures put out this week in the energy and metals sectors. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

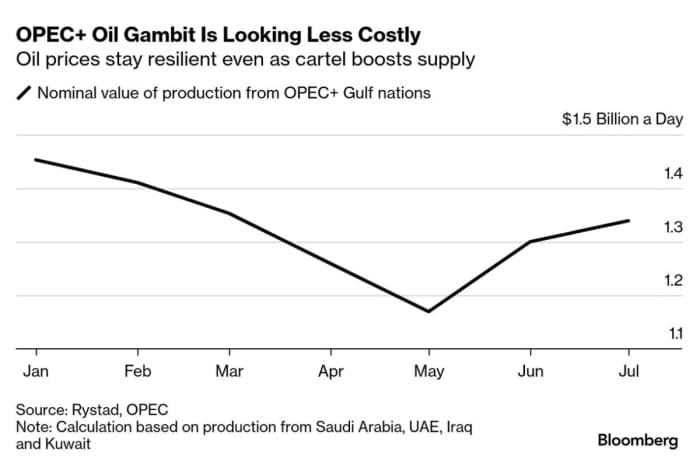

OPEC+ to Finish the Unwinding Job with September Superhike

Following the joint ministerial monitoring committee meeting last week, eight leading members of OPEC+ will be meeting on Sunday (August 3) to decide on the last tranche of the 2.2 million b/d voluntary cuts. The market expectation is that the oil group will approve another expedited 548,000 b/d production hike for September, marking the end of voluntary cuts from the ‘Great Eight’ including Saudi Arabia, Russia and the UAE.Whilst OPEC+’s decision was initially met with scepticism as adding further barrels into an already oversupplied market seemed a wild idea, prices are currently the same ($68 per barrel for WTI) as they were on March 4 when the first step towards unwinding was taken. Some industry watchers believe the OPEC+ unwinding is mostly internal housekeeping of production quotas as almost all leading producers were overproducing their initial targets. Saudi Arabia’s crude exports were only 200,000 b/d higher last month than in July 2024, at 5.8 million b/d. LNG Canada, We Have a Problem

Canada’s claim to become a major LNG exporter, the $40 billion LNG Canada developed by Shell,…

Numbers Report – August 01, 2025

In the latest edition of the Numbers Report, we will take a look at some of the most interesting figures put out this week in the energy and metals sectors. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

- OPEC+ to Finish the Unwinding Job with September Superhike

- Following the joint ministerial monitoring committee meeting last week, eight leading members of OPEC+ will be meeting on Sunday (August 3) to decide on the last tranche of the 2.2 million b/d voluntary cuts.

- The market expectation is that the oil group will approve another expedited 548,000 b/d production hike for September, marking the end of voluntary cuts from the ‘Great Eight’ including Saudi Arabia, Russia and the UAE.

- Whilst OPEC+’s decision was initially met with scepticism as adding further barrels into an already oversupplied market seemed a wild idea, prices are currently the same ($68 per barrel for WTI) as they were on March 4 when the first step towards unwinding was taken.

- Some industry watchers believe the OPEC+ unwinding is mostly internal housekeeping of production quotas as almost all leading producers were overproducing their initial targets.

- Saudi Arabia’s crude exports were only 200,000 b/d higher last month than in July 2024, at 5.8 million b/d.

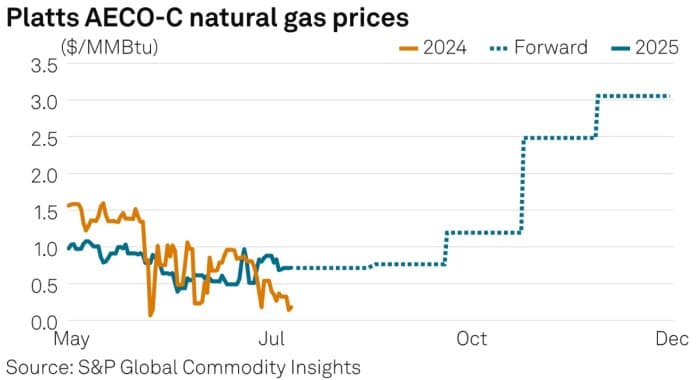

- LNG Canada, We Have a Problem

- Canada’s claim to become a major LNG exporter, the $40 billion LNG Canada developed by Shell, has been running at 50% of its projected capacity due to technical issues with its gas turbine and refrigerant unit.

- The terminal in Kitimat, BC has so far loaded four cargoes, three of which have departed towards South Korea, and one sailed to Japan, however Shell failed to speed its current pace of loadings – one cargo per week.

- The technical issues forced Shell to re-route its Ferrol Knutsen LNG carrier, initially headed to Kitimat, to Peru.

- Exceptionally low natural gas prices in Western Canada are the greatest asset of LNG Canada, with most of its capex costs coming from convoluted and expensive infrastructure.

- The AECO natural gas price averaged a mere $0.62 per MMbtu in June, dipping even lower to $0.55 per mmBtu in July.

- US Jet Demand Soars to Record Highs on Robust Flying

- US jet fuel demand is firing on all cylinders after deliveries of the middle distillate soared to a 29-year high of 2.09 million b/d in the week ended July 22, following a similar record in passenger numbers.

- The Transportation Security Administration reported three consecutive increases in passenger volumes in July, with the 19.62 million passengers posted over the past week marked the second highest reading this year.

- Despite expectations that geopolitical turmoil and tariffs could impact consumer behaviour in the US, passenger air travel has so far been 0.6% up compared to 2024.

- When it comes to record, the US midcontinent has seen the biggest increase in jet fuel supply – the 359,000 b/d produced across the Midwest in the week ended July 25 is the highest weekly reading ever.

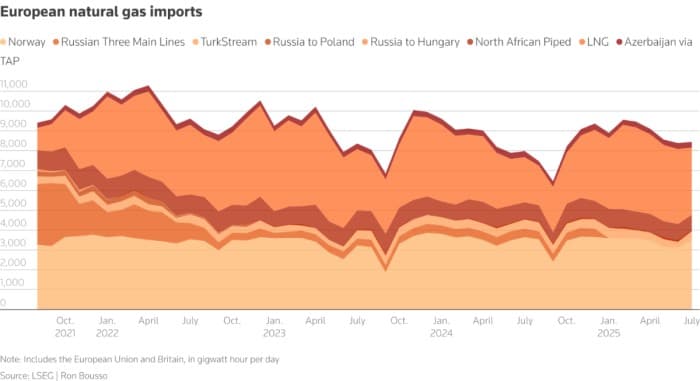

- Europe Gets Caught Between a Rock and a Hard Place

- As European gas markets struggle to come to terms with the EU’s $750 billion US energy imports pledge, Brussels has launched a rallying cry to centralize LNG imports across the continent by pooling demand requirements together.

- The difficulty in ramping up US LNG imports stems from the already high market share American liquefied gas enjoys, accounting for 45% of Europe’s total LNG imports in 2024 or 45.1 million tonnes overall.

- This rate has risen further in the first half of 2025, to 55%, with the Netherlands and France importing the most.

- LNG prices are poised for a huge downward correction after Qatar brings online its 33 mtpa capacity North Field East project, making it even harder for the EU to meet its $250 billion per year target.

- Moreover, as the EIA is expecting Henry Hub prices to rise to $4.40 per mmBtu by 2026, further added costs such as a $2.50-3.00 per mmBtu liquefaction fee as well as freight could make US LNG cargoes commercially sub-optimal.

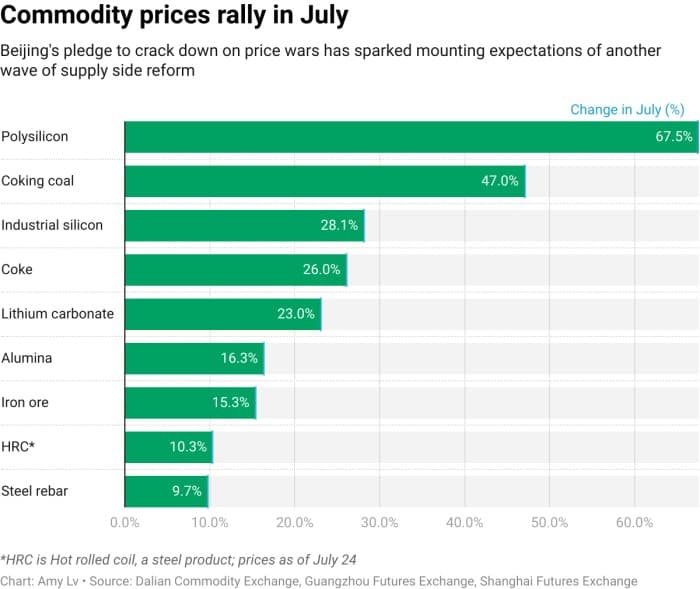

- China’s Drive to End Overcapacity Tackles Polysilicon Market

- China’s leading polysilicon producers are poised to set up a $7 billion fund to buy up smaller market participants totalling roughly 1 million tonnes of production capacity and shut them down.

- The move, immediately dubbed the ‘OPEC of the polysilicon industry’, comes after years of extremely low market prices with domestic material currently selling as low as $5 per kg.

- Overcapacity has been plaguing the polysilicon market, the only source for solar panels, with China’s production capacity alone rising to 3.25 million tonnes as of end-2024.

- Interestingly, the industry initiative follows a high-level summit organized by China’s Ministry of Industry where top government officials highlighted the need to keep prices above production cost.

- Following the news, polysilicon has become the best-performing commodity of July, increasing month-over-month by 67%, even if in outright terms that means a hike from $3/kg to $5/kg.

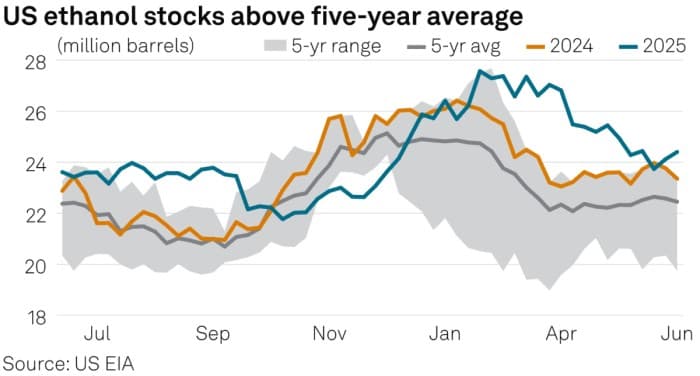

- US Ethanol Forcefully Expands in Japanese Market

- Last week’s Japan-US trade deal is set to widen flows of American ethanol to Japan as part of Tokyo’s $8 billion commitment to purchase agriculture goods, however Japanese biofuel needs will also trigger the interest of Brazil.

- US nationwide stocks of ethanol have been trending above the 5-year average for most of 2025, currently hovering slightly below 25 million barrels, as the Biden administration’s quest to make the E15 blending mandate an all-year-round one failed to materialize.

- Following pilot deliveries in 2017-2018, ethanol flows from the US have dissipated to just 43,000 barrels in 2024, relying more on the finished gasoline blending stock ETBE with exports reaching 10.5 million barrels last year.

- Japan currently has a 1.8% ethanol blending rate for gasoline, however by 2030 this should go up to 10%, creating a new market outlet for US ethanol producers.

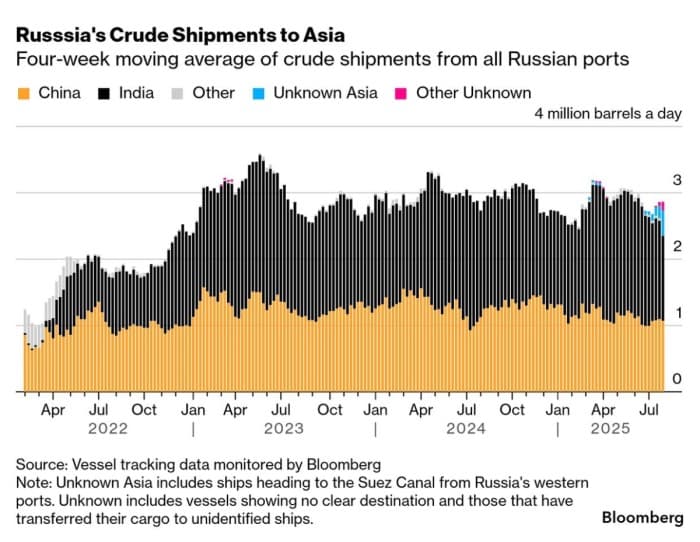

- Indian Refiners Halt Russian Oil Purchases To Mull Options

- US President Trump has slapped a 25% tariff on India, having failed to reach a trade agreement before the August 1 deadline, reiterating his threat of imposing 100% tariffs on buyers of Russian energy.

- The geopolitical escalation and concurrent sanctioning of the Nayara Energy refinery by the European Union is disrupting Russian oil flows already, with two tankers bound for the Indian port of Vadinar diverting to other destinations.

- India’s imports of Russian crude have averaged 1.8 million b/d in January-July 2025, 1% higher than last year’s annual average, with private refiners Reliance and Nayara emerging as the two top buyers.

- According to Reuters, India’s state-controlled refiners have refrained from buying any Russian cargoes this week, wary of political consequences.

- The share prices of Indian refiners have all slid 3-4% this week, on expectations that from now on they’d be compelled to buy more expensive oil.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.