- Premium Content It takes our newsroom weeks - if not months - to investigate and produce stories for our premium content. You can’t find them anywhere else.

Singapore drift: What Traveloka’s shift really tells us

Recently in Indonesia, #KaburAjaDulu has been catching fire.

The viral hashtag, loosely translated as “just run away first,” began as a meme about young professionals chasing better pay and opportunities abroad. It’s since curdled into something bleaker: a coping mantra in an economy battered by layoffs, stalled IPOs, and shaky consumer confidence.

Startups, it seems, are also running.

Image credit: Timmy Loen

Take Traveloka. The travel unicorn has never been so tightly wrapped in the “local hero” narrative – at least compared to Gojek or Tokopedia.

However, its move to brand itself as a “Singapore-headquartered, Southeast Asian” firm still raised eyebrows among the public, prompting a clarification from a spokesperson that its core operations remain in Indonesia.

It’s common for startups to set up a Singapore entity. But Traveloka is one of the few major Indonesian tech firms to actually move its headquarters to the city-state.

The shift makes strategic sense as it supports the company’s global ambitions and potential IPO plans. More than that, it reflects a changing mindset: Like the young professionals behind #KaburAjaDulu, Indonesia’s tech companies are realizing they don’t have to stick to a local identity to grow or to survive.

Why homegrown pride can be a trap

The public mood isn’t surprising, given how sour things have turned for some local tech icons.

Tokopedia’s sale to TikTok Shop in January 2024 was widely perceived as a foreign takeover – a blow to national pride. Gojek, once hailed as a symbol of Indonesian innovation, now feels like a faded success story, especially after Grab’s potential billion-dollar deal to acquire it.

Image credit: Timmy Loen

David Yin, a partner at US-based Informed Ventures, points out the obvious: Being based in Singapore just looks better.

“Investors also assume that having Singapore headquarters means better governance and investor protection, as well as easier capital controls – which is usually true,” he explains.

Traveloka may be writing a new playbook

Stay ahead in Asia’s tech landscape

This is premium content. Subscribe to read the full story.

“Singapore HQ” used to raise eyebrows. Now it’s a survival tactic. This piece unpacks why Traveloka and other tech firms are outgrowing the homegrown hero script.

We know this is not ideal. ⌛ Sign up in 20 seconds. Cancel anytime.

- Premium Content It takes our newsroom weeks - if not months - to investigate and produce stories for our premium content. You can’t find them anywhere else.

Inside the founders’ feud tearing Alterno apart

In this 2023 YouTube video, Kent Nguyen, co-founder and then-CEO of Alterno, unveiled his homemade sand battery – a scrappy prelude to the startup’s grid-scale prototype.

Founded around two years ago, the Vietnam-based firm bet on sand batteries’ potential as a game-changing fix for soaring power bills. The pitch seized investors’ attention.

In 2024, Alterno raised capital from Antler, The Radical Fund, UntroD Capital Asia, and more. The startup also won the Net Zero Challenge 2023, a competition sponsored by Touchstone Partners – one of its investors – and Temasek Foundation.

But just a year after these gains, Alternō is mired in a feud between its founders.

(From left) Alterno’s original three co-founders: Hai Ho, Nam Nguyen, and Kent Nguyen / Image credit: Tech in Asia

Kent left Alterno in 2024 and has been in a year-long fight with his two co-founders, alleging he was wrongfully terminated and never properly compensated for his shares. He has been documenting his narrative in a sprawling blog series, referring to the dispute as a “sand battery saga.”

Such a public blowup is rare in Vietnam’s startup scene.

The other co-founders, Hai Ho and Nam Nguyen, have fiercely denied all allegations, dismissing them as a smear campaign driven by Kent’s personal agenda.

When contacted by Tech in Asia for comment, Alterno sent a 14-page response that did not mention its former CEO by name, referring to him as a “bad leaver” instead.

After suing Alterno for wrongful termination in a Vietnamese court, Kent Nguyen is now threatening legal action in Singapore over the valuation of his shares.

Tech in Asia contacted Antler Vietnam, The Radical Fund, and Touchstone Partners for this story. Only Touchstone Partners replied with a statement.

Brain behind the sand battery

The ex-CEO insists that Alterno was built on his sand battery idea, which was inspired by a concept from Finland.

Kent says he had successfully tested his homemade battery on November 4, 2022 – days before joining Antler Vietnam with Ho. Both were executives at the now-defunct travel startup Triip.me: Ho was the CEO and co-founder while Kent served as CTO from 2018 to 2019.

Nam later joined them at Antler, completing the founding trio behind Alterno.

Cause of termination

Shares dispute and alleged contract breach

Stay ahead in Asia’s tech landscape

This is premium content. Subscribe to read the full story.

One side says he was ousted and shortchanged. The other says he’s bitter and spinning tales. An unusually public fallout shakes up a climate tech startup in Vietnam.

We know this is not ideal. ⌛ Sign up in 20 seconds. Cancel anytime.

- Premium Content It takes our newsroom weeks - if not months - to investigate and produce stories for our premium content. You can’t find them anywhere else.

Who’s investing in India’s SaaS startups?

This list features the most active investors in the country’s SaaS scene over the past two years, arranged by number of deals. We hope this helps founders who are looking for funding in the sector.

Please drop us a note at research@techinasia.com if you find any inaccurate or missing information to help us fill the gap.

For more auto-generated lists of investor funding data, head here.

Editing by Terence Lee, Duc Tran and Mina Deocareza

(And yes, we’re serious about ethics and transparency. More information here.)

Welcome to Tech in Asia’s daily newsletter, your essential dose of Asia’s tech and startup buzz. Not on the mailing list? Register here. Got a story tip? Send it to editors@techinasia.com.

In focus

- From smiles to scale: Thai startups head to Singapore

- A dive into payment platform Omise’s latest earnings

- Revisit this visual piece on why Thai fintech isn’t your typical David vs. Goliath story

Hello reader,

Today’s newsletter dives deep into a market that probably doesn’t get enough attention: Thailand.

The country, often called “the Land of Smiles,” hasn’t exactly become the land of startups. As our top story explores, many of the nation’s most ambitious young companies are looking elsewhere to scale.

Most often, their gaze is across the border in Singapore, where the rules are clearer, the funding more robust, and the odds of going big are a little less stacked.

That doesn’t mean some Thai startups aren’t recording solid traction. Case in point: Omise.

The payments firm has weathered a few rebrands and some rough years, but as my colleague Miguel Cordon notes in his earnings analysis, it’s now showing signs of a profitable turnaround. Its 2024 rebound was driven by regional expansion and new partnerships, proof that Thai firms can still scale across Southeast Asia with the right focus and flexibility.

Thailand may not be the loudest in Southeast Asia’s tech arena, but its founders and funders are quietly rewriting the rules.

Don’t sleep on this one.

Peter Cowan, engagement editor

Top Stories

1️⃣ Why Thai startups are chasing growth in Singapore

Photo credit: tampatra / 123RF

Thailand is Southeast Asia’s third-largest economy by gross domestic product. It also has a booming digital commerce sector and is investing heavily in data centers. So why do Thai startups often choose Singapore for their headquarters?

Part of the reason is a lack of government policies to support startups in Thailand. That includes the red tape that makes it difficult for companies to provide free stock options to employees, which firms can do easily in Singapore.

Thailand is also short of independent venture capital firms and instead has several corporate VC arms operated by major banks and conglomerates, which poses a unique set of challenges.

2️⃣ Hitting reset: Omise chases profit after rebranding blitz

Omise founder Jun Hasegawa / Photo credit: Omise

One Thai firm that has gone regional is payment platform Omise. After a few rocky years and multiple rebrands, the company is going back to basics, sharpening its focus on payments while laying the groundwork for profitability.

Its latest earnings report shows a big jump in revenue in 2024 while also narrowing its losses before taxes.

The firm’s push into AI and overseas markets reflects a wider challenge for Thai startups: Many need to look beyond their home turf to grow and make big bets to stay competitive.

From our archives

Big banks, conglomerates rule over Thailand’s fintech map

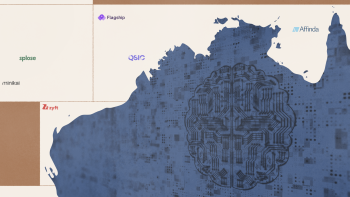

Image credit: Timmy Loen

So what happens when banks and conglomerates are some of the most active investors in a startup scene? In Thailand, it’s blurred the line between startup and incumbent.

This data story by Elyssa Lopez from April this year dives into why so many fintech firms in Thailand are founded by the giants and how that changes the nature of competition in the sector.

It has led to innovation in areas like QR payments and blockchain, but it also raised questions about how independent or scalable these startups really are.

Get ready for the next AMPED | September 10

A look at the voices that shaped the first AMPED and what’s ahead this September

Every speaker who took the stage at AMPED was invited for one reason: They’ve built, backed, or amplified something real in Southeast Asia’s startup scene, and they shared hard-earned insights from the front lines.

At our first AMPED in Malaysia, we featured prominent figures such as Cheryl Goh (Grab), Khailee Ng (500 Global), Dave Ng (Altara Ventures), Shan Li Tay (Endeavor Malaysia), Jordan Lung (Kopi Kenagan), Hisham Ibrahim (Gobi Partners), and more. They went beyond the headlines and pitch decks to break down what it really takes to scale in the region.

This September, we’re bringing that same energy to Ho Chi Minh City. Mark your calendar for September 10 and get ready for AMPED Vietnam!

Book your super early bird slot at only US$15. Offer ends on August 3 or when tickets are sold out.

Trending news

1️⃣ Indonesia eyes foreign investment with AI road map, official says

The country currently lags behind peers like Malaysia in the sector due to limited infrastructure and AI talent.

2️⃣ SG loyalty platform HeyMax acquires HK fintech firm Krip

The acquisition is HeyMax’s first and marks its entry into Hong Kong.

3️⃣ Figma to use auction-like IPO to raise up to $1b

The design software company is taking a different path from traditional offerings which rely on market orders.

4️⃣ Dog walking firm Wag files for bankruptcy

The San Francisco-based company matches owners with dog walkers in a similar model to ride-hailing firms.

5️⃣ DeepSeek chatbot downloads drop as task-based AI apps rise

The Chinese firm’s chatbot downloads per month fell 72% in the second quarter of this year compared to the prior quarter.

Recommended reads

VC funds tracker: SG, Japan universities bet big on deeptech

VC funds tracker: SG, Japan universities bet big on deeptech Why Thai startups are chasing growth in Singapore

Why Thai startups are chasing growth in Singapore Indosat bets big on AI. Is Indonesia ready?

Indosat bets big on AI. Is Indonesia ready? Asia layoff tracker: Hundreds let go by Virtuos, Maka Motors

Asia layoff tracker: Hundreds let go by Virtuos, Maka Motors Weekly funding: Chinese AI firm leads with $250m round

Weekly funding: Chinese AI firm leads with $250m round Vietnam’s AI Hay pits local brains against ChatGPT’s brawn

Vietnam’s AI Hay pits local brains against ChatGPT’s brawn Stung by startup failures, Temasek builds financial shields

Stung by startup failures, Temasek builds financial shields Telio’s founder respawns, now gunning for gamers

Telio’s founder respawns, now gunning for gamers PH call centers fend off AI doomsday

PH call centers fend off AI doomsday Forget paid ads – SEA brands chase affiliate gold

Forget paid ads – SEA brands chase affiliate gold

Editing by Jaclyn Tiu and Thu Huong Le

(And yes, we’re serious about ethics and transparency. More information here.)