- Premium ContentIt takes our newsroom weeks - if not months - to investigate and produce stories for our premium content. You can’t find them anywhere else.

Rainforest reaches for the canopy with 46% revenue growth

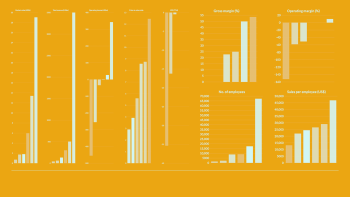

Rainforest, a Singapore-based ecommerce roll-up firm, posted strong revenue growth for the second year running, according to its most recent set of audited financials.

In its financial year ending December 2023, revenue increased nearly 46% to US$54.7 million compared to the previous year. It had posted a 9x jump in revenue in 2022.

Rainforest’s revenue boost is notable, considering the ecommerce roll-up sector has been grappling with challenges such as a funding slowdown and rising interest rates. Even the segment’s pioneer, Thrasio, went bankrupt in February (but has since emerged from it).

Total expenses for Rainforest also grew but at a slower rate than revenue. This led to the company’s net loss narrowing by 54% to US$4.6 million.

Acquisitions reap returns

JJ Chai, co-founder of Rainforest, tells Tech in Asia that the company’s revenue increased as the brands it has acquired have continued to grow by expanding their product offerings and entering new markets. Some have also begun selling in new channels such as Target and Babylist, a marketplace for baby products.

Lilly’s Love, which Rainforest acquired in December 2021, has grown by 3x in top line and EBITDA since acquisition, reveals Chai. The brand creates toy organizers and other essential children’s gear.

Other brands in Rainforest’s portfolio such as Babbleroo and Comfy Bumpy have expanded their product lines with support from the ecommerce roll-up firm.

(From left) Rainforest co-founders Per-Ola Röst, JJ Chai, and Jason Tan / Photo credit: Rainforest

The company was co-founded in 2021 by Chai, Jason Tan, and Per-Ola Röst. The three previously held executive positions at companies like Ovo, Fave, and Airbnb.

So far, Rainforest has acquired 17 brands, mostly in the mom and babycare category. Generally, these brands have more than US$5 million in revenue and over US$500,000 in annual EBITDA when they are acquired.

Net profit rolls in

Ecommerce roll-up companies buy out online brands that have similar offerings and bring them under one umbrella. These aggregators rely heavily on borrowing money to fund their purchases.

This enables them to grow rapidly, but it also increases their debt levels and financial risk. Rising interest rates have pushed many aggregators, including Thrasio, to the brink of collapse.

Rainforest team / Photo credit: Rainforest

Rainforest was also not profitable at the net income level in 2023, primarily due to “interest costs from debt and some non-cash adjustments,” explains Chai. Notably, finance expenses rose by 60% year on year to US$3.7 million.

However, the co-founder says that the company has turned net profitable so far in 2024. It has also repaid all its debts.

“We have fully built out our operating platform and can integrate newly acquired, profitable brands with very little incremental costs,” Chai adds.

Rainforest has also shown cost discipline while continuing to acquire brands. Although the company’s total expenses grew by 34% year on year in 2023, this was outpaced by its increase in revenue.

The firm’s cash flow from operating activities also went from negative to positive, with cash and cash equivalents increasing by 68% year on year.

Selective acquisitions to continue

To date, Rainforest has deployed nearly US$55 million in investments to acquire brands. The company had set a target of US$100 million for such deals in 2022 alone.

“Our focus on mom and babycare brands as well as increasing the quality level of our portfolio meant that we slowed down on the number acquisitions completed versus what we would have liked to have done,” said Chai.

Rainforest will continue to make selective acquisitions in 2024.

Indeed, its financial statements indicate that in July this year, the company acquired a Singapore-incorporated home baby proofing brand for US$2.5 million. The brand has an annual profit of US$800,000, all of which was additive to Rainforest’s bottom line, according to Chai.

See also: Roll-ups 2.0: Changing winds prompt shifts in ecommerce aggregator model

According to Chai, many in the ecommerce roll-up space are facing challenges because of overleveraging and having a less cohesive brand portfolio. He sees this as an opportunity to continue acquiring brands “selectively … and making acquisitions that are synergistic with our existing brands in meeting the needs of parents and moms.”

With its brands currently selling their products in the US, Canada, Europe, and Japan, Rainforest intends to expand its presence in Asia over time, both through inorganic and organic means. It will also focus on brand building and making its products available offline, says Chai.

Support quality journalism and content.

This is a Premium Content. Subscribe to read the full story.

Already a subscriber? Log in.

IN FOCUS

In today’s newsletter, we look at:

- Why Southeast Asia’s investors are increasingly betting on non-tech brands

- Qoo10’s major layoffs

Welcome to The Checkout! Delivered every fortnight, this free newsletter breaks down the biggest stories and trends in ecommerce. Get all our content, including The Checkout, by registering for a Tech in Asia account. Alternatively, sign up here if you just want to receive this newsletter.

Hi there,

My wife is a fan of Indonesia’s Rosé All Day Cosmetics (RADC). She uses the company’s lip tint and blush all the time, and the other day, I saw a Powerpuff Girls-edition mascara in her cart on Shopee.

In addition to being a millennial with a soft spot for 90s cartoons, my wife insists that RADC’s products are both high-quality and affordable – even cheaper than the offerings of some other local brands.

Despite its low prices, the company can make big bucks, and it’s been profitable since its second year of operations. RADC has also secured US$5.9 million of funding to date, with more than 90% of it raised in December 2023.

The Indonesian cosmetics firm is just one of the growing number of consumer brands catching VCs’ attention despite the ongoing funding crunch in the region. While most of these brands don’t rely on cutting-edge technology, their clear path to profitability seems to be the main attraction for VCs seeking more calculated risks. I discuss more about this in this week’s Big Story.

Meanwhile, in this week’s Hot Take, I discuss why Singapore-based Qoo10’s recent layoffs at its headquarters may hint at the company’s potential demise. The staff cuts are particularly critical as the company has had financial troubles with its South Korean subsidiaries in recent months.

— Glenn

THE BIG STORY

SEA VCs stray from tech for new bets

Image credit: Timmy Loen

Amid the tech winter, some VCs are betting on consumer brands that provide a more “predictable” path to profitability.

THE HOT TAKE

The beginning of the end for Qoo10?

Photo credit: Shutterstock

Here’s what happened:

- Singapore-headquartered ecommerce company Qoo10 laid off more than 80% of its workforce in the city-state.

- Out of 110 staff members, 90 were affected and given no benefits “due to a lack of funds.”

- The company has been hit with financial troubles in recent times.

Here’s our take:

The recent layoffs at its headquarters might well be the final nail in the coffin for Qoo10. Over the past couple of months, the company has been in dire straits following delayed payments by its South Korean subsidiaries, Tmon and WeMakePrice.

Both have been unable to pay merchants on their platforms since early July and owe a total of 1.3 trillion won (US$970 million), according to figures released by the South Korean government on August 25.

While Qoo10 founder and CEO Ku Young-bae has pledged to resolve the situation, it will be difficult for the firm to do so without resorting to drastic measures. During a parliamentary hearing on July 30, Young-bae said Qoo10 has only around 80 billion won (US$59.7 million) of available funds.

Adding to the turmoil, Qoo10 may now lose one of its most valuable subsidiaries, Qxpress. The logistics company is set to separate from Qoo10 – private equity firms that have invested in Qxpress reportedly moved to convert their bonds into equity, effectively taking direct control of the company.

See also: India’s duopoly breaker looks to shake up SEA ecommerce

Young-bae previously stated that he plans to use Qoo10’s remaining capital and assets, along with his personal stake in the company, to address the financial woes. But the dilution of Qoo10’s 65.8% stake in Qxpress might significantly hamper those plans, especially considering that Young-bae also owns a 29.3% stake in Qxpress himself.

The separation of Qxpress may mark the beginning of the end for Qoo10 as we know it. If the PE investors succeed, it could encourage other companies within the Qoo10 group to seek similar exits. This would leave the firm struggling to manage its remaining operations even as its assets are stripped away.

These developments paint a bleak picture for the company’s future. The once promising ecommerce giant now seems to be teetering on the brink of collapse.

Tech in Asia’s Founders Meetup: Thailand on September 11

Get clarity on your funding prospects with VCs

Don’t miss out on unfiltered, one-on-one advice from seasoned investors like Woraphot Kingkawkantong of Beacon Venture Capital, Ratchanon Supakit of Plug and Play Tech Center, and Jirapat Suvidejkosol of Vertex Ventures. On September 11, get the chance to ask them anything – from securing funding to navigating challenges to building a winning team – during our all-new VC office hour at Founders Meetup Thailand.

Limited 1+1 bundle deals up for grabs. Get your tickets now!

That’s it for this edition – we hope you liked it! Do also check out previous issues of the newsletter here.

See you next time!

Recommended reads

Can’t afford $300k for AI chips? New model for SEA cuts high costs

Can’t afford $300k for AI chips? New model for SEA cuts high costs Weekly funding: Japanese AI firms take top two spots

Weekly funding: Japanese AI firms take top two spots Meet eFishery’s biggest competitor in India

Meet eFishery’s biggest competitor in India SG pledges $24.6m to boost corporate-startup partnerships

SG pledges $24.6m to boost corporate-startup partnerships VC is on the ropes in SEA. Here’s how it can bounce back

VC is on the ropes in SEA. Here’s how it can bounce back Carro’s next pit stop? Recruitment services

Carro’s next pit stop? Recruitment services Asia layoff tracker: Singapore’s Qoo10 cuts 80% of staff

Asia layoff tracker: Singapore’s Qoo10 cuts 80% of staff Malaysian insurance is set for a shake-up

Malaysian insurance is set for a shake-up Singapore startups seek Malaysia’s greener pastures

Singapore startups seek Malaysia’s greener pastures Ovo’s future at stake as Grab pushes Superbank in Indonesia

Ovo’s future at stake as Grab pushes Superbank in Indonesia

Editing by Simon Huang and Jaclyn Tiu

(And yes, we’re serious about ethics and transparency. More information here.)

Share, tag us, and land on our Wall of ❤️ !

- Premium ContentIt takes our newsroom weeks - if not months - to investigate and produce stories for our premium content. You can’t find them anywhere else.

50 rising startups and tech companies in India

Which are the startups that are on the path to becoming the next big thing? One way to tell would be when they’ve raised a new round, though funding isn’t the full story. Using Tech in Asia’s data, we’ve generated this constantly updated list of startups in India who’ve recently raised funding.

The list only includes companies up to the series E stage.

Seeking more? Search the most comprehensive database of tech companies in Asia or read our Research methodology. For more auto-generated lists of rising startups, head here.

Support quality journalism and content.

This is a Premium Content. Subscribe to read the full story.

Already a subscriber? Log in.

- Premium ContentIt takes our newsroom weeks - if not months - to investigate and produce stories for our premium content. You can’t find them anywhere else.

Cost savings fuel demand for Johor Bahru’s shared workspaces

As businesses from Singapore and Malaysia turn to Johor Bahru in their quest for cost savings, the city is rapidly transforming into a regional hub and sparking a surge in the development of co-working spaces across Malaysia’s southern gateway.

Samuel Tan, CEO of Olive Tree Property Consultants, notes that the demand for co-working spaces in Malaysia’s southernmost state has increased in the last couple of years since the Covid-19 pandemic, with more local and international businesses setting up shop there.

“Although the rental for conventional office spaces is lower than [that of] co-working spaces, the flexibility, corporate solutions, and networking opportunities offered by co-working spaces are driving businesses to adopt the shared workspace concept,” he tells The Business Times.

Infinity8 co-working space in Johor Bahru / Photo credit: Infinity8

Lee Sheah Liang, co-founder and CEO of co-working space operator Infinity8, said the total number of co-working offices in the Greater Johor Bahru area – which covers Johor Bahru, Iskandar Puteri, Pasir Gudang, and Kulai – surged to more than 60 as of July this year, compared to fewer than five in 2017, when the company was founded.

“Nearshoring from Singapore to Greater Johor Bahru is a key factor driving the demand. Companies that do business with their Singapore counterparts are looking at co-working spaces in Johor Bahru to maintain a presence closer to their clients,” he explains.

Infinity8 started with three co-working centers in Johor Bahru and has since expanded to eight, along with additional locations in Kuala Lumpur and Penang. The occupancy rate of these spaces are above 90%, says Lee.

This year, the company plans to open another co-working center in Tampoi, a suburb near Pasir Gudang.

Rising economic hub

The Johor state government aims to position Greater Johor Bahru as Malaysia’s second metropolitan hub, bolstering the state’s economic growth.

Vijayakumar Tangarasan, Malaysia country manager at International Workplace Group (IWG), says the state’s co-working space industry is thriving, with strong interest from local startups as well as from companies in other parts of Malaysia, Singapore, and beyond.

“We have received an increasing number of inquiries on our co-working spaces since last year. [Positive developments] such as the Johor Bahru-Singapore Rapid Transit System and the Johor-Singapore Special Economic Zone (JS-SEZ) have fueled the interest,” he shares.

Johor-Singapore causeway / Photo credit: Shee Heng Chong / Shutterstock

Tangarasan also notes that many companies are waiting for updates on the JS-SEZ, and the demand for shared or flexible working spaces will likely accelerate once the two governments release more details. Last month, it was reported that a deal for the JS-SEZ was likely to be signed by November this year.

UK-based IWG currently operates two co-working spaces in the Johor Bahru city center, with plans to open a location in Medini, a township development in the state.

In terms of expansion, Tangarasan says the company is looking at ways to work with lessors through profit-sharing arrangements to operate co-working spaces within their buildings.

Tan Wee Tiam, executive director of Olive Tree Property Consultants, says co-working space operators can bridge a gap for office owners by acting as the main lessee and subleasing smaller spaces to tenants with varying needs.

“This arrangement provides tenants with flexible options, such as dedicated seats, hot desks, private offices and virtual offices, while offering perks like lounges and free drinks,” he explains.

Co-working space operators can also accommodate short-term occupants, with options such as hot desks and meeting rooms available on a per-use basis. These flexible arrangements also grant entrepreneurs access to top-notch office infrastructure, boosting productivity.

“Flexibility is the main reason that the majority of business owners [opt] for co-working spaces, and it’s something that conventional offices can’t offer,” says Tangarasan, who manages 41 co-working spaces in Malaysia. “Instead of worrying about Wi-Fi and finding a Starbucks, co-working space members [can] just bring their laptops and work at any location with IWG offices.”

IWG co-working space in Kuala Lumpur / Photo credit: IWG

Prices for co-working spaces in Johor Bahru are still generally lower compared to Singapore and Kuala Lumpur, where rents are much higher.

For example, an office for one person in Johor Bahru costs around 600 ringgit to 1,300 ringgit (US$137 to US$297) per month depending on the location. A similar-sized space in Kuala Lumpur easily exceeds 1,000 ringgit (US$228) per month, especially if it is in a grade A green building.

Value-added services

Industry players also note that beyond providing a location to work and hold meetings, co-working space operators also have value-added services that are helping to drive demand.

For example, Infinity8 offers a service for foreign companies to handle HR tasks such as recruitment and payroll.

“To date, we have hired hundreds of Malaysians and seconded them to foreign companies. Other than payroll, we also manage equipment purchases, working-space arrangements and other services as needed,” Lee says, adding that companies that opt for the service are billed monthly, inclusive of employee salaries and other charges.

Tangarasan observes that the demand for virtual offices remains strong in the post-pandemic era, particularly among businesses seeking a prestigious address while opting for a more cost-efficient option.

He adds that other services associated with virtual offices – such as mail- and call-handling, meeting-room access, and administrative support – are attracting startups looking to establish a professional presence without incurring the high overhead costs.

Currency converted from Malaysian ringgit to US dollar: US$1 = 4.34 ringgit.

See also: Singapore startups seek Malaysia’s greener pastures

This story was republished with permission from The Business Times, which made the article available to its paying subscribers. It was moderately edited to reflect Tech in Asia’s editorial guidelines.

Support quality journalism and content.

This is a Premium Content. Subscribe to read the full story.

Already a subscriber? Log in.

Building trust with users in the internet of today

During the pandemic, Brian Kim’s parents discovered the joys of online shopping – but also the perils of the internet.

“They were searching for a product on one platform, and then, five minutes later, the exact same thing popped up in an ad on another platform,” says Kim, who is the director of strategy and operations at data and identity management firm Affinidi. “It felt kind of scary. That’s what happens when people become more aware of how their data is being used – it feels like an invasion of privacy.”

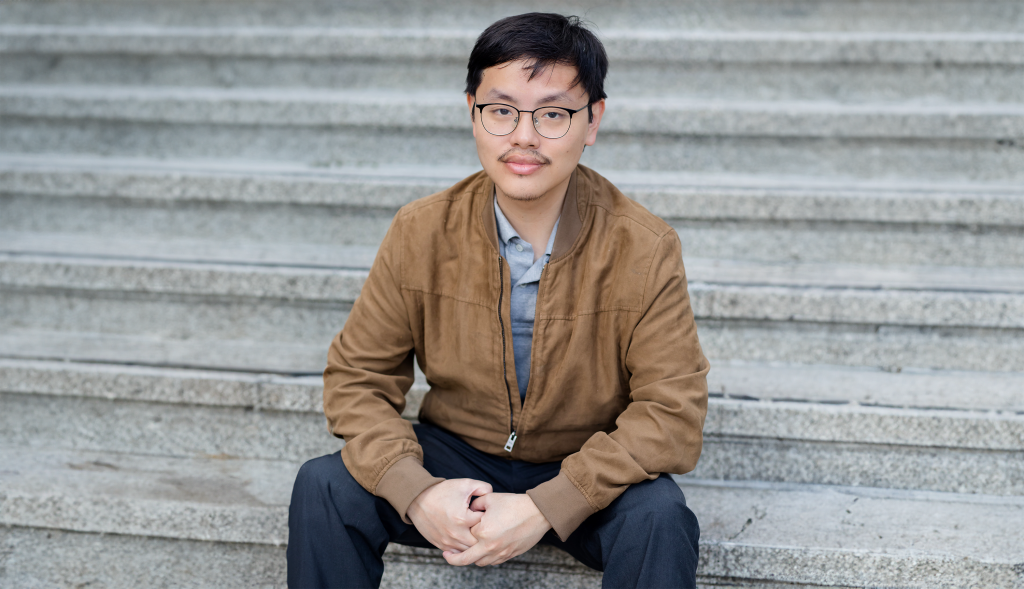

Brian Kim, director of strategy and operations at Affindi / Photo credit: Affinidi

The experience of Kim’s parents speaks to the challenge facing businesses today, where customer expectations for personalized digital experiences are colliding with growing concerns about data privacy and security.

As headlines fill with news of cyber breaches – organizations in Asia Pacific experienced an average of 1,963 attacks per week in 2023 – Kim says customers are getting increasingly wary about how their personal information is being collected and used.

For brands, this results in a sticky situation, one where they’re juggling greater security demands with the need to collect data for more personalized user experiences.

“People are actively sharing their data so their services are more convenient, but it’s just as important that it’s all done in a secure, privacy-preserving way,” Kim adds.

Quality over quantity

Bringing that sense of security to customers has never been more crucial, but it’s important for brands to keep in mind the need to practice data collection in a way that doesn’t overburden the user.

Let’s say a customer wants to try out an investment platform. Odds are, they’re going to have to undergo a rigorous know-your-customer check in addition to the usual identity verification processes. The platform might ask them to upload photos of sensitive personal documents like a driver’s license, which may contain more information than is needed.

While customers understand that these security measures are there to protect them, it’s nevertheless exasperating to have to “repeatedly give their data to different services” just to use a new product, says Kim.

Photo credit: oatawa / Shutterstock

Likewise, from a business perspective, having more data is not necessarily a good thing – businesses should focus on collecting only the most relevant information to reduce the cost of storing data and security risks.

“As a company, you don’t want to end up storing too much information that can be misused or stolen and then having to invest in more security and infrastructure,” he adds .

All this is taking place amid the growing momentum for privacy regulations in Asia Pacific, which is placing additional pressures on companies to innovate their data infrastructures to remain compliant. Businesses now need to think about how to communicate to customers what is being collected and how it is used, especially when partners or third parties are involved in a much more transparent way.

If businesses leave these aspects unaddressed, they risk creating friction in the user experience and uncertainty in customers about the security of their data, which in turn leads to a loss of trust from customers.

“All of this ultimately goes toward how you’re building trust. If you think about it, the reputational damage of a data breach is so much bigger these days than before,” Kim notes. “Customers have so many different alternatives now. They’re going to choose the service they trust over others.”

A holistic take on identity

To tackle these challenges, Affinidi is leveraging holistic identity management, which “flips the script” on how data is collected and managed.

“What we’re trying to do is give data ownership back to customers, rather than these few, big companies owning all of it,” Kim explains. “Customers have more visibility and control over what data they share, how they share it, and how it should be used.”

This user-centric approach inherently builds trust as it relies on customers actively agreeing to share their data while also empowering them to decide what information they are willing to provide.

Photo credit: Chay_Tee / Shutterstock

Let’s say a customer is looking to buy liquor online – they would have to provide proof of age. With the Affinidi Vault, users can store different types of data, such as digital copies of ID cards that certify their legal age. What the liquor retailer gets is the confirmation that the user is able to buy its products without actually having to share the entire ID.

“These are what we call privacy-preserving data sharing solutions,” says Kim. “What we’re building with the Affinidi Trust Network (ATN) is the capability for individuals to collect their data footprint, build a holistic identity, and share that in any shape or form they like, and the capability for businesses to interact with customers to access this holistic identity.”

The concept of a holistic identity also enables users to express their digital selves in a way that reflects who they are in the real world. What Affinidi wants to do is enable users to seamlessly switch between those different digital identities and control what data people can obtain.

“I can be very selective about how I build my profile and minimize the data-sharing – that’s what holistic identity will be able to do,” Kim adds.

The Affinidi Trust Network

Affinidi Vault is just one of the tools in the ATN, which Kim says is the world’s first digital trust infrastructure built on open standards. Complementing it is Affinidi Login, a passwordless authentication product that allows users to easily and quickly sign up with one click and be onboarded, without having to repeatedly provide and share personal sensitive information.

“Login interacts with the Vault to get login credentials, and that data interaction is facilitated by the Affinidi Iota Framework,” he explains, citing the firm’s consent-based data sharing framework built on open standards, which is one of the first of its kind.

Photo credit: Affinidi

With ATN, businesses can attain the relevant information they need while minimizing collection – ensuring users’ privacy and security – thanks to the Affinidi Iota Framework.

“From a company perspective, I can build a very transparent governance framework that reflects the trusted relationship I have with my customers,” says Kim.

Businesses are doubly protected because they own none of the data, as it’s all stored in a wallet on users’ devices. That helps keep them compliant with evolving global regulatory trends, thus reducing their data risks and costs.

Additionally, Affinidi’s entire system is built on open-source technology, reducing the risks of technical debt and leaving the door open for further innovation.

“We’re providing a different way to share data so businesses have the ability to better understand their customers, allowing them to focus on delivering their core services and build trust,” Kim explains. “You don’t want to get stuck spending on security or data storage when you could be investing into innovating and creating customer value.”

A bridge between worlds

As concerns about data privacy continue to mount, Affinidi sees a big opportunity for holistic identity to become the norm, addressing the major challenges faced by brands today.

“I think ATN fits nicely in that verification gap,” Kim says. “We’re going to help businesses build that seamless user experience in a way that enhances privacy and security.”

Ultimately, the company is looking to bridge the physical and digital worlds, where Kim sees an “imbalance” in terms of how trust is defined.

“As a company, we want to build a technology that doesn’t create silos, whether it’s between platforms or technologies or systems,” he explains. “What Affinidi is looking to enable is trust in the digital space.”

Affinidi is a technology company dedicated to changing data ownership for good. By placing control back into the hands of users, its solutions strengthen trust to foster strong communities.

Find out more about Affinidi on its website.

This content was produced by Tech in Asia Studios, which connects brands with Asia’s tech community. Learn more about partnering with Tech in Asia Studios.

Recommended reads

Can’t afford $300k for AI chips? New model for SEA cuts high costs

Can’t afford $300k for AI chips? New model for SEA cuts high costs Weekly funding: Japanese AI firms take top two spots

Weekly funding: Japanese AI firms take top two spots Meet eFishery’s biggest competitor in India

Meet eFishery’s biggest competitor in India SG pledges $24.6m to boost corporate-startup partnerships

SG pledges $24.6m to boost corporate-startup partnerships VC is on the ropes in SEA. Here’s how it can bounce back

VC is on the ropes in SEA. Here’s how it can bounce back Carro’s next pit stop? Recruitment services

Carro’s next pit stop? Recruitment services Asia layoff tracker: Singapore’s Qoo10 cuts 80% of staff

Asia layoff tracker: Singapore’s Qoo10 cuts 80% of staff Malaysian insurance is set for a shake-up

Malaysian insurance is set for a shake-up Singapore startups seek Malaysia’s greener pastures

Singapore startups seek Malaysia’s greener pastures Ovo’s future at stake as Grab pushes Superbank in Indonesia

Ovo’s future at stake as Grab pushes Superbank in Indonesia

Editing by Stefanie Yeo, Winston Zhang, and Lorenzo Kyle Subido

(And yes, we’re serious about ethics and transparency. More information here.)

Be the first to comment!

Comment now