- Premium Content It takes our newsroom weeks - if not months - to investigate and produce stories for our premium content. You can’t find them anywhere else.

5 key takeaways from Lalamove’s draft prospectus to list in HK

Lalatech Holdings, the parent company of logistics platform Lalamove, filed a draft of its application to list on the Hong Kong Stock Exchange earlier this week, two years after confidentially filing for an IPO in the US.

The firm’s upcoming public listing follows that of other logistic players like Hong Kong-based GogoX and India-based Delhivery, which went public on their respective local bourses last year.

See also: GogoX and Delhivery: A tale of two logistics IPOs

While Lalatech hasn’t specified the timeline for its public listing or how much capital it aims to raise, Tech in Asia looked at its draft document and here are our key takeaways.

1. Lalamove has a global presence and is in all major SEA markets

Lalamove was founded in Hong Kong in 2013 but operates across the region today. After entering Singapore in 2014, it took four years to grow its footprint in five other major Southeast Asian markets.

Its largest market is mainland China, where it made its debut in 2014. The company also has a presence in Latin America: It launched in Brazil in August 2019 (around the same time as Southeast Asian ecommerce giant Shopee) and Mexico in November that year.

See also: Shopee’s success in Brazil justifies global expansion

Image credit: Timmy Loen

Looking ahead, Lalatech says it will focus on Southeast Asia and Latin America, where it plans to deepen penetration and increase its market share. It also intends to expand to the Middle East.

2. It generated positive operating income in 2022

Lalatech logged a 23% increase in revenue for the year ending December 2022, but the number marked a slowing growth rate, as the firm had a 60% year-on-year revenue growth between 2020 and 2021.

The company’s cost of sales and operating expenses also fell in absolute terms between 2021 and 2022. As a result, the firm eked out a positive operating income of US$2.6 million in 2022, compared to an operating loss of US$661 million in the previous year.

The reduction in operating expenses between 2021 and 2022 was due to a 71% decline in sales and marketing expenses, which fell by US$475 million to US$198 million. Achieving 23% year-on-year revenue growth despite the lower sales and marketing spending is an indication of the business’ long-term sustainability.

3. The firm makes money by charging membership fees and commissions

4. Two is good, but four is better

5. Leaning in on tech

Support quality journalism and content.

Delight in a 20-second sneak peek, then subscribe and let the magic unfold!

Or why wait? Subscribe now and dive into the full story right away.

Already a subscriber? Log in.

SEA’s rising Islamic tech startups and Shenzhen’s bet on livestreaming

Welcome to The Checkout! Delivered every fortnight, this free newsletter breaks down the biggest stories and trends in ecommerce. Get all our content, including The Checkout, by registering for a Tech in Asia account. Alternatively, sign up here if you just want to receive this newsletter.

Hi there,

After a dip in 2021, funding into Islamic tech startups is back on the rise. In 2022, such firms across Southeast Asia raised US$452 million, my colleague Jofie writes in this week’s Big Story, which maps out some of the region’s most notable players.

Such firms are serving a combined population of more than 250 million people – in Indonesia and Malaysia alone.

A notable ecommerce player in the space is Believe, a direct-to-consumer firm selling fashion products to Muslim communities in Asia and the Middle East.

But many mainstream platforms like Tokopedia, Shopee, and Lazada are also dipping their toes in the space by offering halal food and fashion products on dedicated web pages.

On the ease of online shopping, our second big story this week looks into Primer. Founded by two former PayPal executives, the firm is helping online businesses to automate their payments and commerce workflows.

With a wide range of digital payments and e-wallets available in Asia Pacific, Primer makes it easier for any merchant to add various payment methods through a single platform. This helps startups speed up expansion plans, especially in a diverse market like Southeast Asia.

Finally, our Hot Take this week looks at the multibillion-dollar livestreaming industry, which has permeated almost any social media platform you use, whether that’s Facebook, Instagram, TikTok, or YouTube.

One city in China has laid out dedicated plans to boost its livestreaming capabilities and attract related talent. For the full details, scroll along.

— Melissa

THE BIG STORIES

1️⃣ Mapping the key Islamic tech startups in Southeast Asia

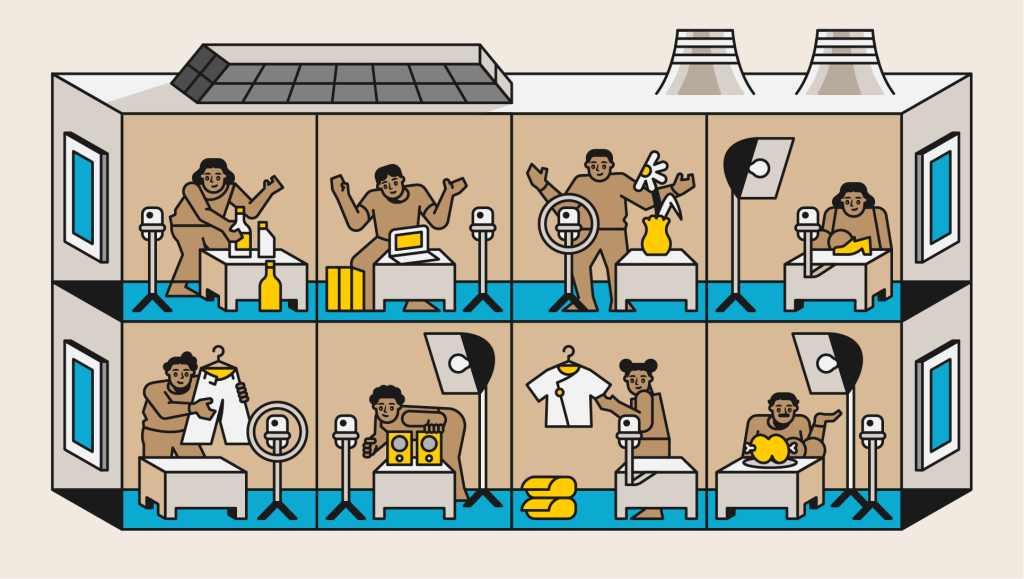

Image credit: Timmy Loen

With a total Muslim population of more than 250 million, Indonesia and Malaysia are promising markets for Islam-related businesses.

2️⃣ Ex-Paypal execs’ no-code ‘app store for businesses’ eyes APAC next

Using Primer, a merchant can add multiple payment checkout options with just a few clicks. / Photo credit: Primer

In the last 12 months, the firm has seen a 20% month-on-month growth in total payment volumes processed in the Asia Pacific.

THE HOT TAKE

The battle for livestreaming views

Photo credit: Shutterstock

Here’s what happened:

- Last week, Shenzhen laid out plans to become a global livestreaming ecommerce hub by 2025, South China Morning Post reported.

- The city expects to generate 300 billion yuan (US$43.6 billion) in sales and plans to cultivate 3,000 livestreamers by 2025.

- It will also build 50 industrial estates that provide livestreaming facilities, stage setups, and content production support.

Here’s our take:

While the earliest livestreamers may have experimented as they went along and grew their followings organically, livestreaming as we know it today is a multibillion-dollar machine.

For livestreamers entering what is now a saturated and highly competitive space – whether that’s on TikTok, or Instagram, or directly on ecommerce platforms – gaining viewership and a following can be done through a structured and guided process aimed at maximizing their chances of success.

Shenzhen, the coastal city in Southern China that links to Hong Kong, is a perfect example of how cultivating livestreaming talent can be an intentional and deliberate process. To catch up with more established hubs like Hangzhou, Shenzhen’s municipal commerce bureau announced its plan to dial up its efforts to attract and nurture liverstreaming talent.

That includes drawing 50 well-known hosts to be based in the city and grooming another 3,000 livestreamers. The bureau is doing so by partnering with education institutes to provide relevant training. It’s also recognizing livestreaming salespersons as a certified profession.

The bureau sees this industry as “hugely important” in driving consumption growth and economic recovery. After all, China’s livestreaming ecommerce sector is expected to rake in US$624 billion in sales by 2023, according to eMarketer’s projections.

Shopee and Lazada have been investing in livestreaming efforts from as early as 2018, as we previously reported. Lazada, for instance, offers everything from studios for rent as well as marketing and logistics support, which can help sellers get started on livestreaming. In markets like Thailand and Vietnam, the ecommerce platform also has a talent program to recruit and train brand hosts.

Show hosts play the important role of doling out nuggets of product specifications, keeping viewers entertained, answering questions, and all the while being that personable online friend.

Viya, a Chinese social media influencer dubbed a “livestreaming queen”, did over 3 billion yuan (US$436 million) in sales on Singles’ Day in 2020. In May that year – in the thick of the pandemic – more than 37 million viewers tuned in to her livestreams.

But being a successful host takes more than charisma and an affable personality. It takes a village: Viya, for instance, is part of Qianxun Group. Run by her stepbrother, it’s a talent management agency that provides influencers with everything from studio venues, supply chain management, to retail support.

While Southeast Asia has seen growth in live commerce since the pandemic, the industry’s gross merchandise value across the region was just half of China’s as of 2021, according to a Momentum Works report.

In the US, livestreaming commerce has failed to catch on and lead to sales conversions. Instagram ended its live shopping feature, while TikTok scaled back its live commerce plans in the country.

Nowhere else in the world has livestreaming commerce taken off like in China. Perhaps by that measure, Shenzhen might be doing something right.

— Melissa

NEWS YOU SHOULD KNOW

Also check out Tech in Asia’s coverage of the ecommerce scene here.

1️⃣ Alibaba Group to cleave operations into six divisions: These units – which include a logistics unit, a cloud business, and a commerce arm – will each pursue independent fundraising IPOs.

Photo credit: testing / Shutterstock

2️⃣ Pinduoduo app malware detailed by cybersecurity researchers: Earlier versions of the Chinese shopping app, which was pulled from the Google Play Store last week, had exploited software vulnerabilities to gain unauthorized access to user data.

3️⃣ Pinterest brings shopping capabilities to Shuffles, its collage-making app

: Users of Shuffles, Pinterest’s collage-making app, will be able to view brands, prices, and other data when they tap on individual cutouts in collages.

4️⃣ US group calls for Shein shutdown: Called Shut Down Shein, the campaign is led by a coalition of “like-minded individuals and businesses” and seeks to raise awareness of the fashion firm’s “dangerous and reprehensible behavior.”

5️⃣ ADIA invests $500 million in Lenskart: The India-based eyewear retailer, which also operates in Southeast Asia and the Middle East, is opening more than seven stores a week and plans to manufacture 20 million pairs of spectacles next year.

FYI

Direct-to-Consumer Is Dying. It’s Time for a New Paradigm: Say hello to connect-to-consumer, in which sellers use multiple channels from social media, ecommerce, to Web3.

That’s it for this edition – we hope you liked it! Do also check out previous issues of the newsletter here.

See you in a fortnight!

Recommended reads

VC funds tracker: Vertex Ventures bags $541m for fifth fund

VC funds tracker: Vertex Ventures bags $541m for fifth fund Neso Brands buys stake in Paris-based eyewear brand in $4m deal

Neso Brands buys stake in Paris-based eyewear brand in $4m deal 20 fresh tech and startup jobs in Asia this week

20 fresh tech and startup jobs in Asia this week Cake Group lays off staff amid revenue decline, denies cost-cutting

Cake Group lays off staff amid revenue decline, denies cost-cutting Asia layoff tracker: CoinSwitch, CoinDCX, and Khatabook shed over 155 jobs

Asia layoff tracker: CoinSwitch, CoinDCX, and Khatabook shed over 155 jobs Protege Ventures launches second fund run by students, for students

Protege Ventures launches second fund run by students, for students Big money abounds in the – what else? – semiconductor industry

Big money abounds in the – what else? – semiconductor industry Weekly funding: Auto-focused chipmaker’s $1.88b raise places China at first

Weekly funding: Auto-focused chipmaker’s $1.88b raise places China at first Indian gaming giant Nazara Technologies raises $49m

Indian gaming giant Nazara Technologies raises $49m TikTok’s live-commerce boom: hustler’s paradise or fleeting trend?

TikTok’s live-commerce boom: hustler’s paradise or fleeting trend?

Editing by Simon Huang and Dhania Putri Sarahtika

(And yes, we’re serious about ethics and transparency. More information here.)

Be the first to comment!

Comment now