The Sober Math Behind the Unsustainability of the Bitcoin Network's Economic Model.

(and Why Bitcoin Mining is a Bad Business)

A thread 🧵

#bitcoin $btc / #Ethereum $eth

(and Why Bitcoin Mining is a Bad Business)

A thread 🧵

#bitcoin $btc / #Ethereum $eth

Imagine you run a utility.

But instead of enjoying growing energy consumption and income over time, like most utilities...

... Every four years your population is cut in half until it goes extinct in 2140.

If this scenario sounds familiar you might be a #bitcoin miner.

But instead of enjoying growing energy consumption and income over time, like most utilities...

... Every four years your population is cut in half until it goes extinct in 2140.

If this scenario sounds familiar you might be a #bitcoin miner.

Have you ever run the math of bitcoin mining rewards halving every 4 years?

It's daunting.

It's daunting.

In 22 years and 5 halvings the # of $btc issued to miners annually will be 1.5% of what is it today (~5k / year vs. ~330k currently).

In other words in 20 yrs the amount of $btc issued annually is virtually zero until the last $btc is mined in 2140.

In other words in 20 yrs the amount of $btc issued annually is virtually zero until the last $btc is mined in 2140.

Your first response will be "well miners will make it up in price."

Let's make a forecast.

Let's make a forecast.

Let's assume:

- $btc's avg price is $30k until the next halving;

- averages $90k from 2024-2028 (a 3x), and then;

- compounds at 15% every year until 2140 (i.e. roughly a double per halving for next 100+ years).

- $btc's avg price is $30k until the next halving;

- averages $90k from 2024-2028 (a 3x), and then;

- compounds at 15% every year until 2140 (i.e. roughly a double per halving for next 100+ years).

Here's the output of the $btc price forecast based on the above.

The resulting $btc prices quickly become unwieldy, surpassing $1M per coin in a little more than 20 years.

The resulting $btc prices quickly become unwieldy, surpassing $1M per coin in a little more than 20 years.

Here's the chart to scale.

Compounding at 15% per annum for ~120 years results in a terminal $btc price per coin of $565 billion (with a B) and a bitcoin market cap of $12 quintrillion (!).

Seriously.

Not exactly conservative but stay with me.

Compounding at 15% per annum for ~120 years results in a terminal $btc price per coin of $565 billion (with a B) and a bitcoin market cap of $12 quintrillion (!).

Seriously.

Not exactly conservative but stay with me.

Under this forecast, the Bitcoin Network's security budget peaks from 2024-2028 at $14B / year.

In other words, the Bitcoin Network's security budget could realistically peak after the next halving.

Then decline forever.

Hopefully you're starting to see an issue here...

In other words, the Bitcoin Network's security budget could realistically peak after the next halving.

Then decline forever.

Hopefully you're starting to see an issue here...

Said another way:

Unless Bitcoin finds alternative sources of revenue, the Bitcoin Network could start becoming less secure over time as early as 2028 (!).

Not exactly a comforting thought for individuals hoping to store their wealth forever.

Unless Bitcoin finds alternative sources of revenue, the Bitcoin Network could start becoming less secure over time as early as 2028 (!).

Not exactly a comforting thought for individuals hoping to store their wealth forever.

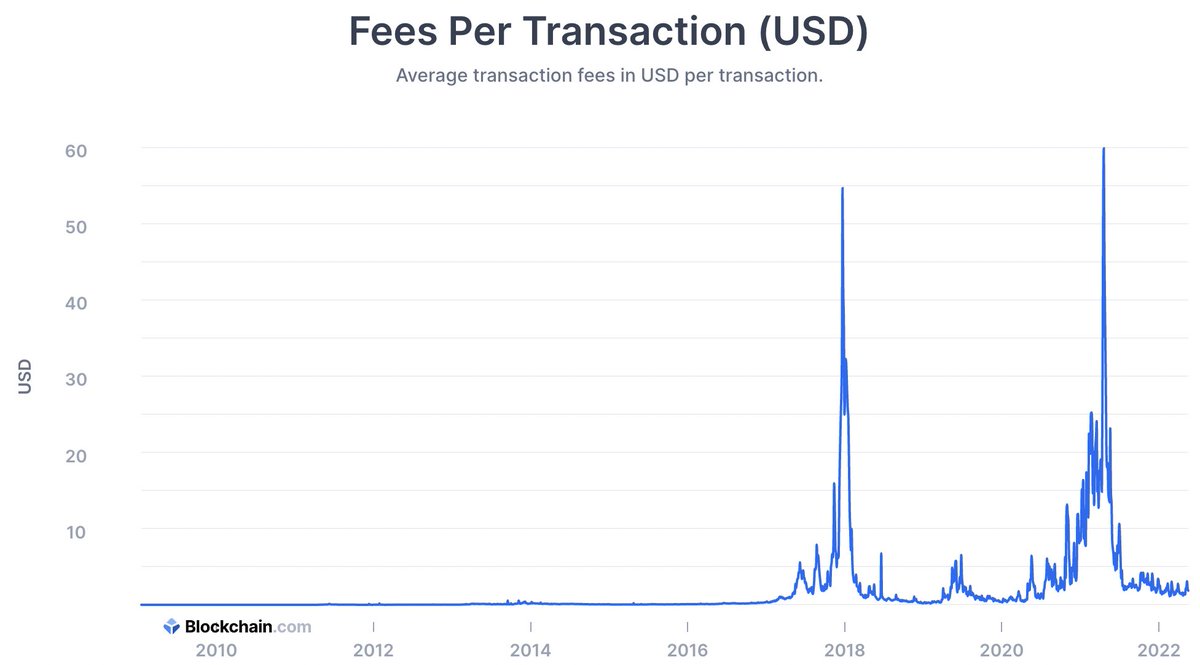

As is well publicized, the Bitcoin Network generates relatively little activity.

Bitcoin generates a fraction of the economic value as measured by fees / revenue of $eth, BSC, and is regularly surpassed by individual applications such as $uni.

Bitcoin generates a fraction of the economic value as measured by fees / revenue of $eth, BSC, and is regularly surpassed by individual applications such as $uni.

The Bitcoin Network appears unlikely to generate significant alternative sources of revenue IMO.

To repeat: Unless the chain starts seeing A LOT more activity and more paying users, we could see the Bitcoin Network actually start to shrink as soon as later this decade...

To repeat: Unless the chain starts seeing A LOT more activity and more paying users, we could see the Bitcoin Network actually start to shrink as soon as later this decade...

Let's compare Bitcoin's exponentially declining mining rewards model to $eth's economic model.

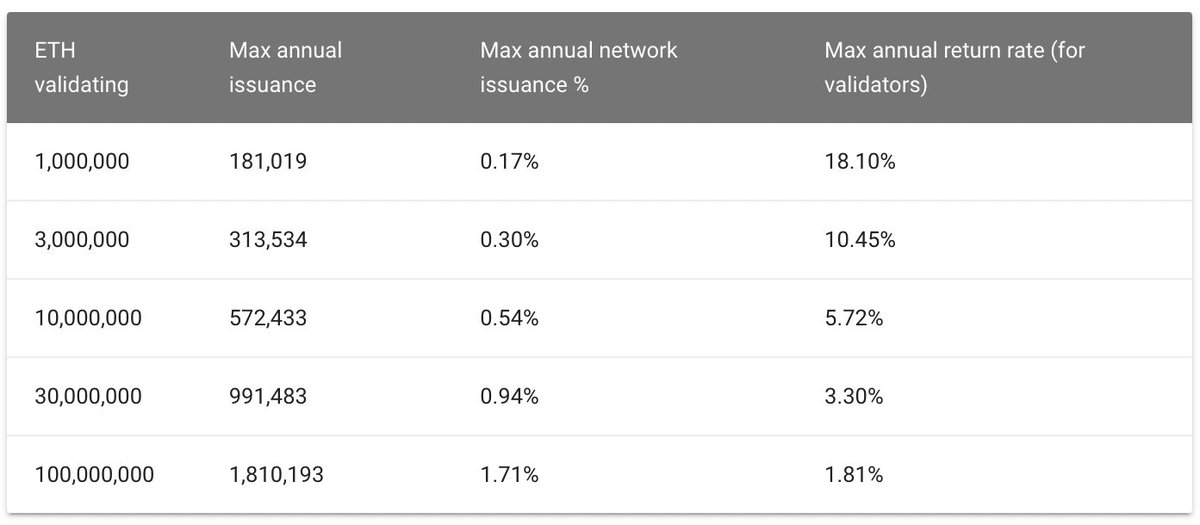

Post @ethereum's move to proof-of-stake (#wen), total Ethereum issued *increases* with number of $eth staked.

The more $eth network participants choose to stake, the more the Ethereum Network will pay validators for security.

The more $eth network participants choose to stake, the more the Ethereum Network will pay validators for security.

At $1T network value (~$8k / $eth) and 10M $eth staked, Ethereum will pay validators 572k $eth, or ~$5B annually.

At 30M $eth staked, the security budget increases to 991k $eth / ~$8B.

At 30M $eth staked, the security budget increases to 991k $eth / ~$8B.

Importantly, assuming $eth network value 10x's to $10T, $eth's security budget also 10x's.

Yes - Ethereum becomes more secure as it goes up in price *regardless of time.*

Ethereum is literally incentivized to go up forever.

Yes - Ethereum becomes more secure as it goes up in price *regardless of time.*

Ethereum is literally incentivized to go up forever.

In summary:

Bitcoin's security budget exponentially decreases every four years.

The Bitcoin network risks becoming more vulnerable unless it finds significant new sources of revenue, which appears unlikely as of today.

Bitcoin's security budget exponentially decreases every four years.

The Bitcoin network risks becoming more vulnerable unless it finds significant new sources of revenue, which appears unlikely as of today.

Ethereum's security budget grows directionally with # of validators AND with network value.

The more valuable the Ethereum Network becomes, the more secure it becomes.

Win/win.

The more valuable the Ethereum Network becomes, the more secure it becomes.

Win/win.

If you enjoyed this thread, drop a like and retweet the first tweet (linked below).

aloha \m/ 🏄

aloha \m/ 🏄

• • •

Missing some Tweet in this thread? You can try to

force a refresh