Back in 2006, when the iPhone was a mere rumor, Palm CEO Ed Colligan was asked if he was worried:

“We’ve learned and struggled for a few years here figuring out how to make a decent phone,” he said. “PC guys are not going to just figure this out. They’re not going to just walk in.” What if Steve Jobs’ company did bring an iPod phone to market? Well, it would probably use WiFi technology and could be distributed through the Apple stores and not the carriers like Verizon or Cingular, Colligan theorized.

I was reminded of this quote after Amazon announced an agreement to buy Whole Foods for $13.7 billion; after all, it was only two years ago that Whole Foods founder and CEO John Mackey predicted that groceries would be Amazon’s Waterloo. And while Colligan’s prediction was far worse — Apple simply left Palm in the dust, unable to compete — it is Mackey who has to call Amazon founder and CEO Jeff Bezos, the Napoleon of this little morality play, boss.

The similarities go deeper, though: both Colligan and Mackey made the same analytical mistakes: they mis-understood their opponent’s goals, strategies, and tactics. This is particularly easy to grok in the case of Colligan and the iPhone: Apple’s goal was not to build a phone but to build an even more personal computer; their strategy was not to add on functionality to a phone but to reduce the phone to an app; and their tactics were not to duplicate the carriers but to leverage their connection with customers to gain concessions from them.

Mackey’s misunderstanding was more subtle, and more profound: while the iPhone may be the most successful product of all time, Amazon and Jeff Bezos have their sights set on being the most dominant company of all time. Start there, and this purchase makes all kinds of sense.

Amazon’s Goal

If you don’t understand a company’s goals, how can you know what its strategies and tactics will be? Unfortunately, many companies, particularly the most ambitious, aren’t as explicit as you might like. In the case of Amazon, the company stated in its 1997 S-1:

Amazon.com’s objective is to be the leading online retailer of information-based products and services, with an initial focus on books.

Even if you picked up on the fact that books were only step one (which most people at the time did not), it was hard to imagine just how all-encompassing Amazon.com would soon become; within a few years Amazon’s updated mission statement reflected the reality of the company’s e-commerce ambitions:

Our vision is to be earth’s most customer centric company; to build a place where people can come to find and discover anything they might want to buy online.

“Anything they might want to buy online” was pretty broad; the advent of Amazon Web Services a few years later showed it wasn’t broad enough, and a few years ago Amazon reduced its stated goal to just that first clause: We seek to be Earth’s most customer-centric company. There are no more bounds, and I don’t think that is an accident. As I put it on a podcast a few months ago, Amazon’s goal is to take a cut of all economic activity.

This, then, is the mistake Mackey made: while he rightly understood that Amazon was going to do everything possible to win in groceries — the category accounts for about 20% of consumer spending — he presumed that the effort would be limited to e-commerce. E-commerce, though, is a tactic; indeed, when it comes to Amazon’s current approach, it doesn’t even rise to strategy.

Amazon’s Strategy

As you might expect, given a goal as audacious as “taking a cut of all economic activity”, Amazon has several different strategies. The key to the enterprise is AWS: if it is better to build an Internet-enabled business on the public cloud, and if all businesses will soon be Internet-enabled businesses, it follows that AWS is well-placed to take a cut of all business activity.

On the consumer side the key is Prime. While Amazon has long pursued a dominant strategy in retail — superior cost and superior selection — it is difficult to build sustainable differentiation on these factors alone. After all, another retailer is only a click away.

This, though, is the brilliance of Prime: thanks to its reliability and convenience (two days shipping, sometimes faster!), plus human fallibility when it comes to considering sunk costs (you’ve already paid $99!), why even bother looking anywhere else? With Prime Amazon has created a powerful moat around consumer goods that does not depend on simply having the lowest price, because Prime customers don’t even bother to check.

This, though, is why groceries is a strategic hole: not only is it the largest retail category, it is the most persistent opportunity for other retailers to gain access to Prime members and remind them there are alternatives. That is why Amazon has been so determined in the space: AmazonFresh launched a decade ago, and unlike other Amazon experiments, has continued to receive funding along with other rumored initiatives like convenience store and grocery pick-ups. Amazon simply hasn’t been able to figure out the right tactics.

Amazon’s Tactics

To understand why groceries are such a challenge look at how they differ from books, Amazon’s first product:

- There are far more books than can ever fit in a physical store, which means an e-commerce site can win on selection; in comparison, there simply aren’t that many grocery items (a typical grocery store will have between 30,000 and 50,000 SKUs)

- When you order a book, you know exactly what you are getting: a book from Amazon is the same as a book from a local bookstore; groceries, on the other hand, can vary in quality not just store-to-store but, particularly in the case of perishable goods, day-to-day and item-to-item

- Books can be stored in a centralized warehouse indefinitely; perishable groceries can only be stored for a limited amount of time and degrade in quality during transit

As Mackey surely understood, this meant that AmazonFresh was at a cost disadvantage to physical grocers as well: in order to be competitive AmazonFresh needed to stock a lot of perishable items; however, as long as AmazonFresh was not operating at meaningful scale a huge number of those perishable items would spoil. And, given the inherent local nature of groceries, scale needed to be achieved not on a national basis but a city one.

Groceries is a fundamentally different problem that needs a fundamentally different solution; what is so brilliant about this deal, though, is that it solves the problem in a fundamentally Amazonian way.

The First-And-Best Customer

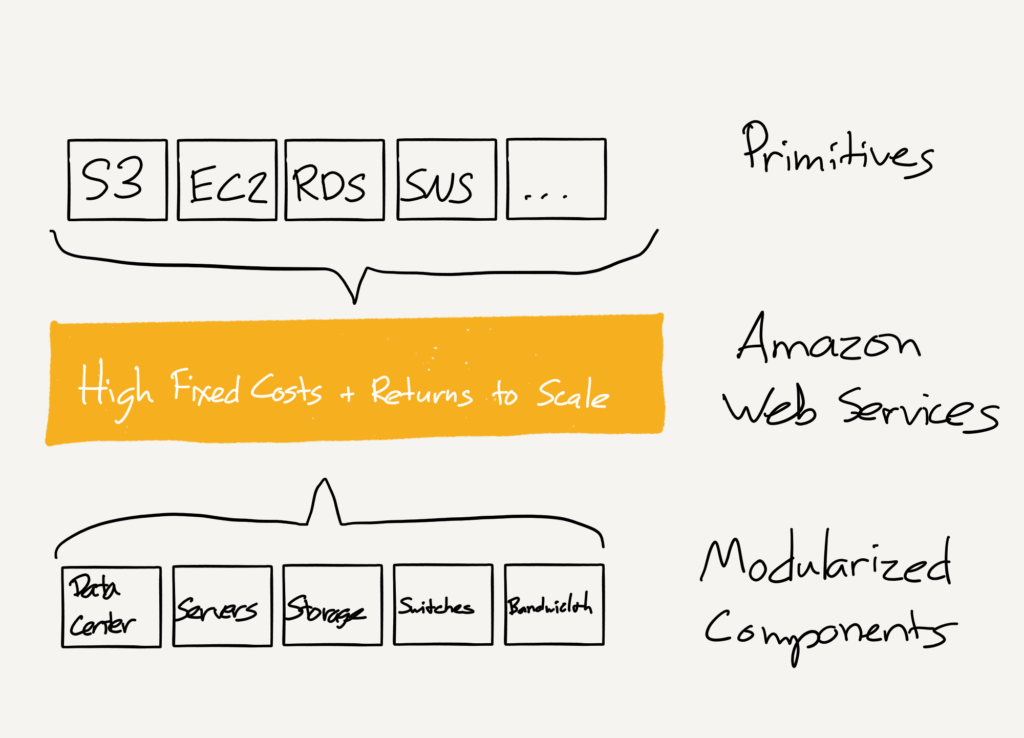

Last year in The Amazon Tax I explained how the different parts of the company — like AWS and Prime — were on a conceptual level more similar than you might think, and that said concepts were rooted in the very structure of Amazon itself. The best example is AWS, which offered server functionality as “primitives”, giving maximum flexibility for developers to build on top of:1

The “primitives” model modularized Amazon’s infrastructure, effectively transforming raw data center components into storage, computing, databases, etc. which could be used on an ad-hoc basis not only by Amazon’s internal teams but also outside developers:

This AWS layer in the middle has several key characteristics:

- AWS has massive fixed costs but benefits tremendously from economies of scale

- The cost to build AWS was justified because the first and best customer is Amazon’s e-commerce business

- AWS’s focus on “primitives” meant it could be sold as-is to developers beyond Amazon, increasing the returns to scale and, by extension, deepening AWS’ moat

This last point was a win-win: developers would have access to enterprise-level computing resources with zero up-front investment; Amazon, meanwhile, would get that much more scale for a set of products for which they would be the first and best customer.

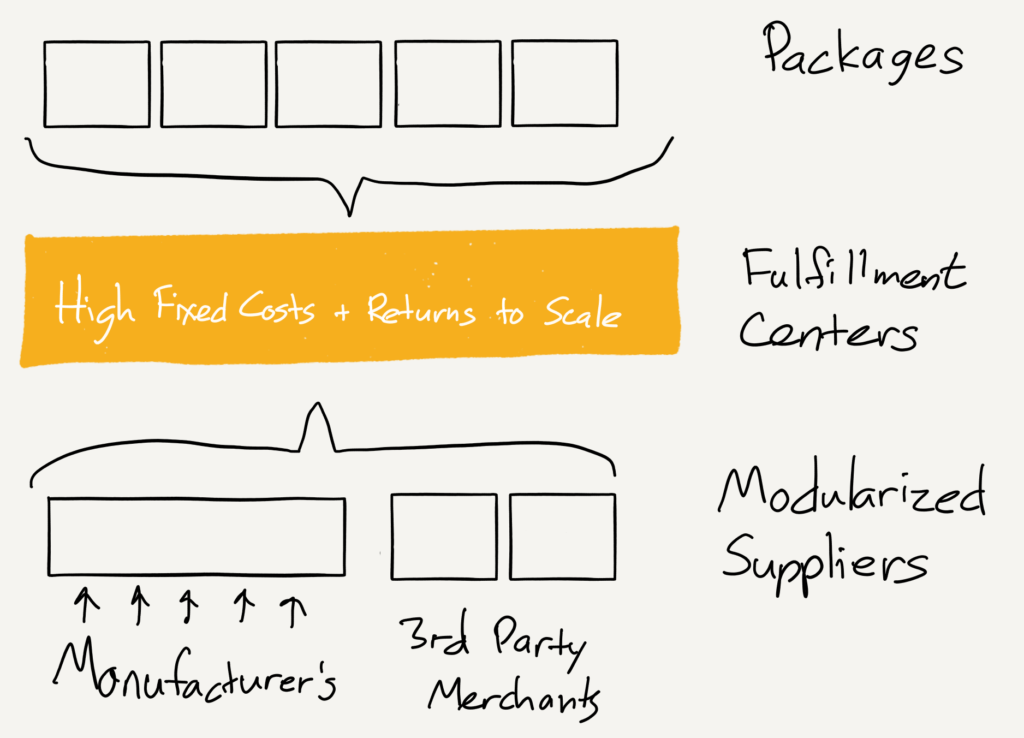

As I detailed in that article, this exact same framework applies to Amazon.com:

Prime is a super experience with superior prices and superior selection, and it too feeds into a scale play. The result is a business that looks like this:

That is, of course, the same structure as AWS — and it shares similar characteristics:

- E-commerce distribution has massive fixed costs but benefits tremendously from economies of scale

- The cost to build-out Amazon’s fulfillment centers was justified because the first and best customer is Amazon’s e-commerce business

- That last bullet point may seem odd, but in fact 40% of Amazon’s sales (on a unit basis) are sold by 3rd-party merchants; most of these merchants leverage Fulfilled-by-Amazon, which means their goods are stored in Amazon’s fulfillment centers and covered by Prime. This increases the return to scale for Amazon’s fulfillment centers, increases the value of Prime, and deepens Amazon’s moat

As I noted in that piece, you can see the outline of similar efforts in logistics: Amazon is building out a delivery network with itself as the first-and-best customer; in the long run it seems obvious said logistics services will be exposed as a platform.

This, though, is what was missing from Amazon’s grocery efforts: there was no first-and-best customer. Absent that, and given all the limitations of groceries, AmazonFresh was doomed to be eternally sub-scale.

Whole Foods: Customer, not Retailer

This is the key to understanding the purchase of Whole Foods: from the outside it may seem that Amazon is buying a retailer. The truth, though, is that Amazon is buying a customer — the first-and-best customer that will instantly bring its grocery efforts to scale.

Today, all of the logistics that go into a Whole Foods store are for the purpose of stocking physical shelves: the entire operation is integrated. What I expect Amazon to do over the next few years is transform the Whole Foods supply chain into a service architecture based on primitives: meat, fruit, vegetables, baked goods, non-perishables (Whole Foods’ outsized reliance on store brands is something that I’m sure was very attractive to Amazon). What will make this massive investment worth it, though, is that there will be a guaranteed customer: Whole Foods Markets.

In the long run, physical grocery stores will be only one of Amazon Grocery Services’ customers: obviously a home delivery service will be another, and it will be far more efficient than a company like Instacart trying to layer on top of Whole Foods’ current integrated model.

I suspect Amazon’s ambitions stretch further, though: Amazon Grocery Services will be well-placed to start supplying restaurants too, gaining Amazon access to another big cut of economic activity. It is the AWS model, which is to say it is the Amazon model, but like AWS, the key to profitability is having a first-and-best customer able to utilize the massive investment necessary to build the service out in the first place.

I said at the beginning that Mackey misunderstood Amazon’s goals, strategies, and tactics, and while that is true, the bigger error was in misunderstanding Amazon itself: unlike Whole Foods Amazon has no particular desire to be a grocer, and contrary to conventional wisdom the company is not even a retailer. At its core Amazon is a services provider enabled — and protected — by scale.

Indeed, to the extent Waterloo is a valid analogy, Amazon is much more akin to the British Empire, and there is now one less obstacle to sitting astride all aspects of the economy.

- To be clear, AWS was not about selling extra capacity; it was new capability, and Amazon itself has slowly transitioned over time (as I understand it Amazon.com is still a hybrid) [↩]