Iraq’s Oil Output Seen by Lukoil at Peak as Government Cuts Back

by-

Oil companies in talks with government about 50% budget cuts

-

Output may decline without more investment, official says

Oil Glut Absorbs Canada, Nigeria Disruption Shocks

Crude output in Iraq, OPEC’s second-largest producer, has probably peaked and is likely to fall short of the country’s target over the next two years, according to an official with Lukoil PJSC, operator of one of the country’s biggest fields.

Iraq needs more investment to maintain production at current levels, according to the official, who asked not to be identified when discussing company matters. Yet output can’t keep up because the government is requiring companies to reduce spending, the person said. The oil ministry has reached agreements in principle with most international oil companies to reduce their 2016 budgets by about 50 percent, and final accords may be reached in about two months, the person said.

The Persian Gulf nation has boosted oil output as companies such as BP Plc, Royal Dutch Shell Plc and Lukoil are developing some of the largest deposits in its oil-rich southern region. They’ve been physically insulated from fighting against Islamic State militants in the country’s north, though the war effort and lower oil prices have strained the government’s finances and diverted its attention from developing new projects the companies are seeking to implement.

Lukoil may spend about $1.3 billion on the West Qurna 2 field, the company official said, down from about $3 billion the year earlier. Lukoil is pumping about 400,000 barrels a day at West Qurna 2 and plans to raise capacity to 1.2 million barrels daily in the next decade.

Iraq pumped a record 4.51 million barrels a day in January and 4.31 million in April, according to data compiled by Bloomberg. Its total production capacity is 4.8 million barrels a day, and increasing that to a target of 5 million will depend on oil prices, Deputy Oil Minister Fayyad Al-Nima said in a May 12 interview.

The government is negotiating with oil companies on production targets after asking them to reduce 2016 spending because of lower oil prices and cuts in government revenue, Falah Al-Amri, chairman of Iraq’s state Oil Marketing Organization, said in February. The talks may affect Iraq’s target to have crude production capacity of 6 million barrels a day by 2020, Al-Amri said.

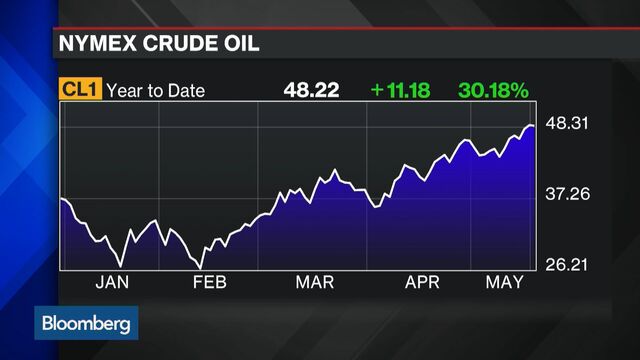

Iraq needs Brent crude at about $55 a barrel to break even on government spending, the Lukoil official estimated. Brent is trading this week near $50 a barrel, about half the 2014 average. Lukoil has suggested linking compensation for work done at the fields to the market price of oil rather than basing payments on a flat fee as is the case now, the official said.